Introduction:

Tax havens, often referred to as offshore financial centres, are countries or territories that offer exceptionally low or zero tax rates, along with other financial incentives like confidentiality and limited financial regulations. Typically, they are characterized by a combination of lenient tax laws, favourable financial regulations, and sturdy financial systems.

These are places with special tax rules that make them attractive to individuals and companies. They are important because they allow people to pay less in taxes, protect their money, and bring in investments from around the world.

How a tax haven?

The following are the key attributes used for identifying whether a jurisdiction is a tax haven or not:

- Minimal or No Taxes

First and foremost, tax havens impose minimal or no nominal taxes. The tax structure varies from country to country, but all tax havens offer themselves as a place where non-residents can escape high taxes by putting their assets or businesses in that jurisdiction. Different tax havens are popular for rebates on different kinds of taxes. But this attribute alone is insufficient to identify a tax haven. Many well-regulated countries offer tax incentives for attracting outside investment but are not classified as tax havens.

- Lack of Effective Exchange of Information

Tax havens protect personal financial information. Most tax havens have formal law or administrative practices that prevent scrutiny by foreign tax authorities. There is no or minimal sharing of information with foreign tax authorities.

- Lack of Transparency

In a tax haven, the situation is not as simple as it seems to be. The legal and administrative machinery of a tax haven is opaque. There are always chances of secret rulings or negotiated tax rates that fail the test of transparency.

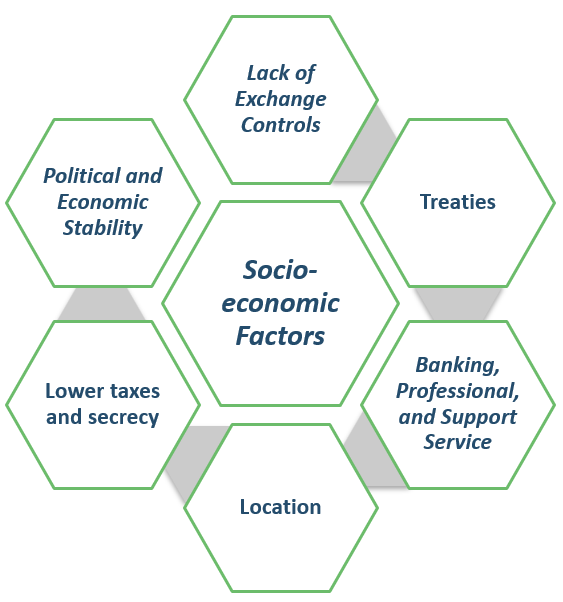

Socioeconomic Factors

Other than the above mentioned attributes , some other socio-economic factors that make a particular destination a popular tax haven include :

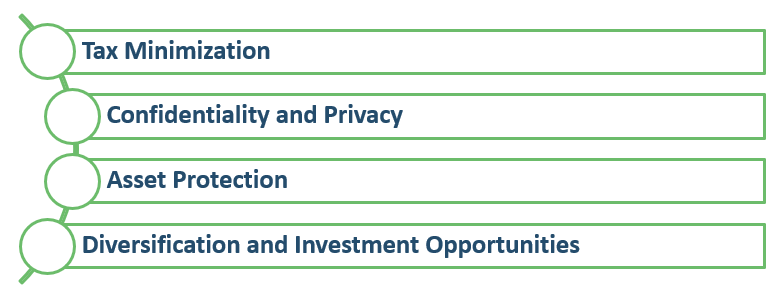

Primacy of Tax Havens

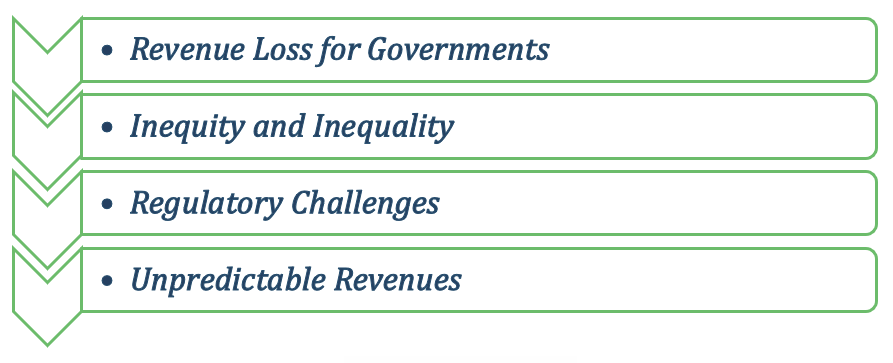

Downsides of Tax Havens

Opponents of tax havens point out that tax havens have some downsides. These downsides impact not only the individual using the tax haven but the country in which the tax haven is being promoted.

The Bottom Line

The existence of tax havens has many effects. At one level, the lower taxes or no taxes in one country put pressure on other countries to keep their taxes low. This is good for taxpayers in the short term.

On the other hand, the secrecy and opaqueness associated with some of the tax havens may encourage money laundering or other illegal activities that can harm the world economy in the long term.

The severe measures taken on tax evaders in some countries shows that taxpayers need to step ahead with caution.

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors:

Khushi Shah

Consultant | +918879196016 | khushi.shah@masd.co.in |LinkedIn profile