The Indian Start-up ecosystem has come a long way, with many start-ups going public and nearly 42 companies becoming unicorns in 2021. According to Inc42’s Indian Tech Start-up Funding Report 2021, Indian start-ups raised $42 Billion in funding across 1,583 deals in 2021, and 2,487 unique investors participated in start-up funding.

Most of these investments take the route through the Alternative Investment Fund (AIF), such as Venture Capital Funds, Angel Funds, and Private Equity Funds.

AIF is defined under regulation 2(1)(b) of the SEBI (Alternative Investment Funds) Regulations, 2012 as follows:

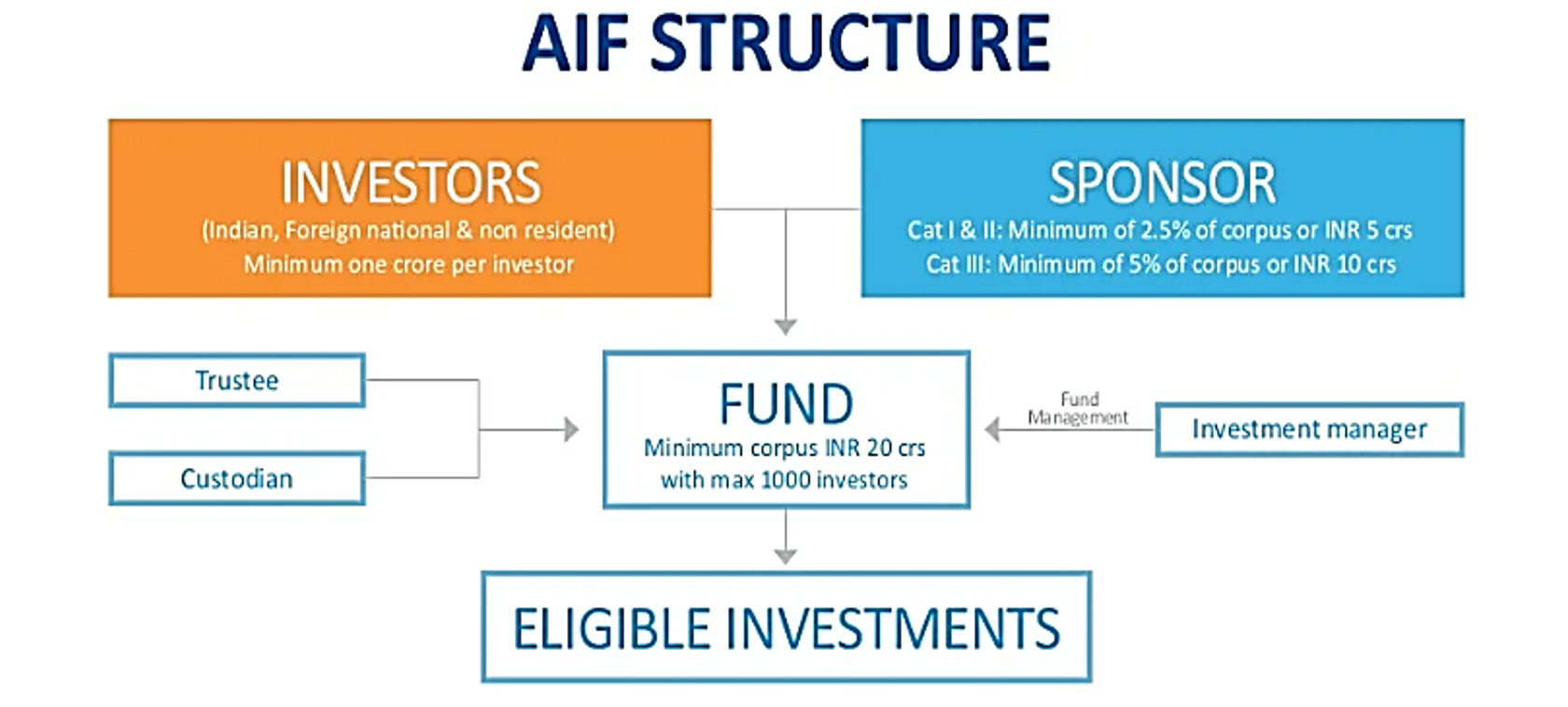

It is a privately pooled investment vehicle that gathers funds from investors, including Indian and foreign investors, to invest it as per a defined investment policy to benefit its investors.

Registration Process:

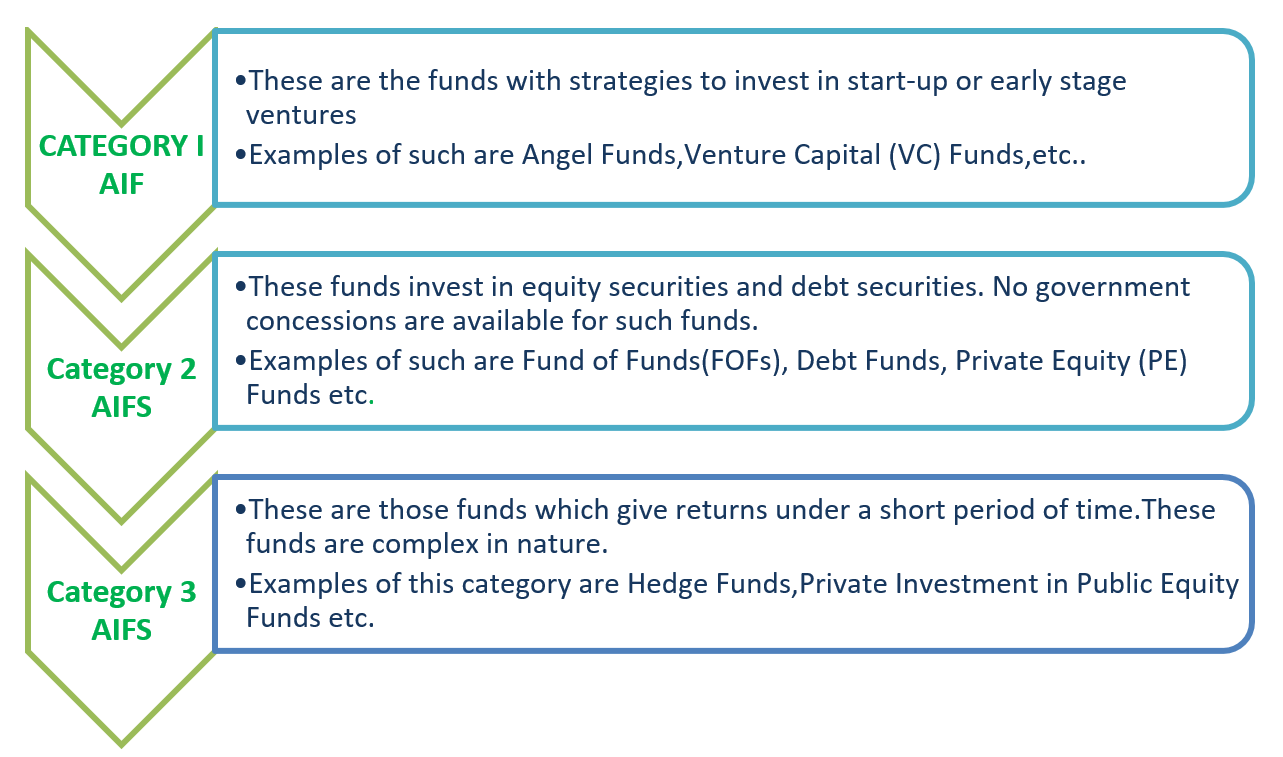

Categories of AIFS:-

Angel Funds vs Other Funds

Particulars | Angel Funds | Other Funds (VC & PE) |

SEBI Registration Fees | Rs.2,00,000 | Rs.5,00,000 to INR 10,00,000 |

Ability to Invest in Listed Securities | Can invest in Listed Start-ups | Limited listed investments allowed. Different norms for different subcategories |

Minimum Corpus for each AIF Scheme | Corpus of at least Rs.5 crores | Corpus of at least Rs.20 crores |

Min investment required by Investors | Invest at least Rs.25 Lakhs | Invest at least Rs.1 Crore |

Investment Period | Maximum 5 years | Minimum 3 years |

Prohibition of Listing | Units of angel funds shall not be listed on any recognized stock exchange. | NA |

Number of Investors | 200 investors | 1000 investors |

Continuing Interest by Sponsor/Manager | Lower of following amounts: – 2.5% of corpus or – Rs.50 lakhs | Lower of following amounts: – 2.5% of corpus or – Rs.5 crores |

Restriction on Investments

| Angel funds shall invest only in start-ups that: – have been incorporated during the preceding three years from the date of such investment – are not promoted or sponsored by or related to an industrial group whose group turnover exceeds three hundred crores rupees – are not companies with family connections with any angel investors investing in the company – Angel funds shall not invest more than twenty-five percent of the total investments under all its schemes in one venture capital undertaking | No such restrictions. |

Particulars | Angel Funds | Other Funds |

Filing of Term Sheet | Required to file with SEBI subject to which angel fund may launch schemes | Not Required |

Prohibition of Listing | Units of angel funds shall not be listed on any recognised stock exchange. | Not Required |

For further in-depth knowledge regarding a given topic. you can reach us on below mail ID:

Authors:

Urvesh Shah

Associate Consultant | +917900046908 | urvesh.shah@masd.co.in |LinkedIn profile

Bhavya Shah

Associate Consultant |+918104954747| bhavya.shah@masd.co.in|LinkedIn profile