Every taxpayer having an income above the exemption limit has to furnish the details of his income and the tax, to the Income Tax Department (‘the Department’), annually in the form of Income Tax Return. Once the Return of Income is filed by taxpayer, the Department scrutinizes the same for its correctness. This process of scrutinizing the return of income by the Department is called as ‘Assessment’ under the Income Tax Act, 1961 (‘Act’).

In one of our articles published earlier, a discussion on benefits of Income Tax Filing had been made in brief. Similarly, in another article, what information does the Department has about a taxpayer had been explained. Taking forward the understanding from thereon, this article describes in short, the action that the Department takes, when a taxpayer has filed the Return of Income.

The Department is in a constant process of updating itself and tries to provide for ease of compliance to taxpayers. The taxpayers are facilitated with pre-filled returns as far as income from salaries, capital markets and other sources are concerned along with details of tax deductions, tax collection, income from business and profession and certain expenditures. This in turn reduces the burden of income and tax computation, and required disclosures. It is a reflection of the pro-activeness and robustness of the Department in accumulation of taxpayers’ data. To state this in other words, the Department already has the information related to a taxpayer even before the return of income is filed. In reality the Department majorly does the task of comparing this reported income with that of the income declared by the taxpayer. This comparison is in the center of Assessment.

This entire procedure of Assessment is carried out in the ever evolving environment of information technology through the three main portals of the Department which actually functions as the taxpayer interface as well. These three portals are viz. the E-filing Portal, Compliance Portal and the TDS Portal by the name of TRACES.

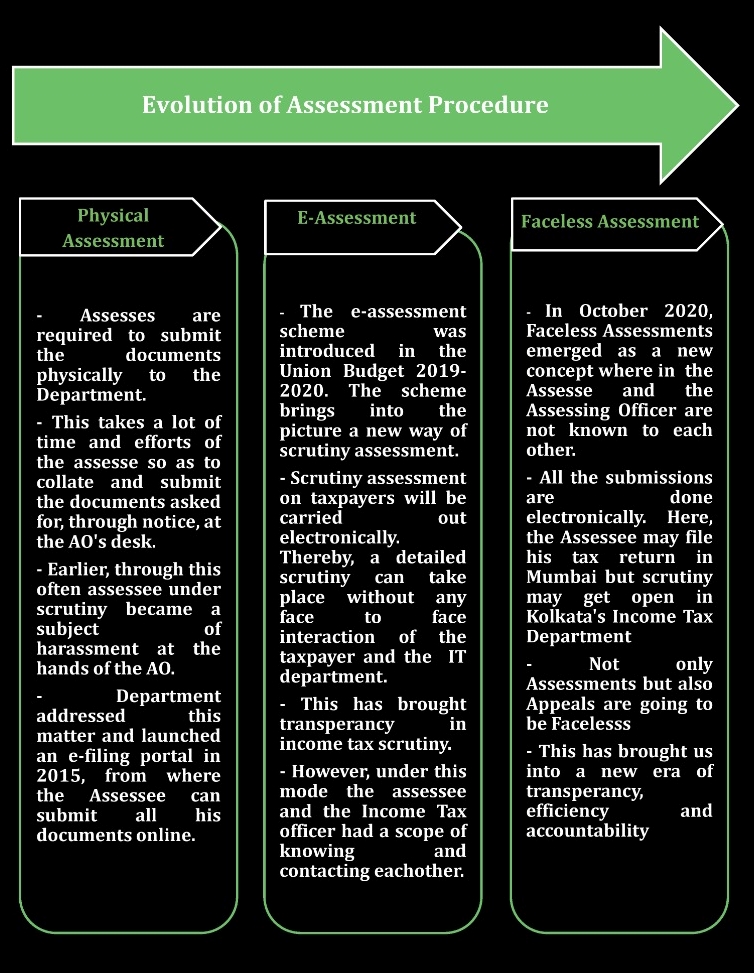

Along with constantly updating the return filing processes, the Department has also looked after the techniques to facilitate the efficient ‘Assessment’ of the returns of income over the years. This article provides a glances on ‘Evolution of Assessment Procedure’. As there is a saying, ‘Rome was not built in a day’; something similar can be quoted for the system of assessment set up by the Department. It has constantly updated itself from the errors, drawbacks, loopholes and inefficiencies, among other things; and it continues to do so even today.

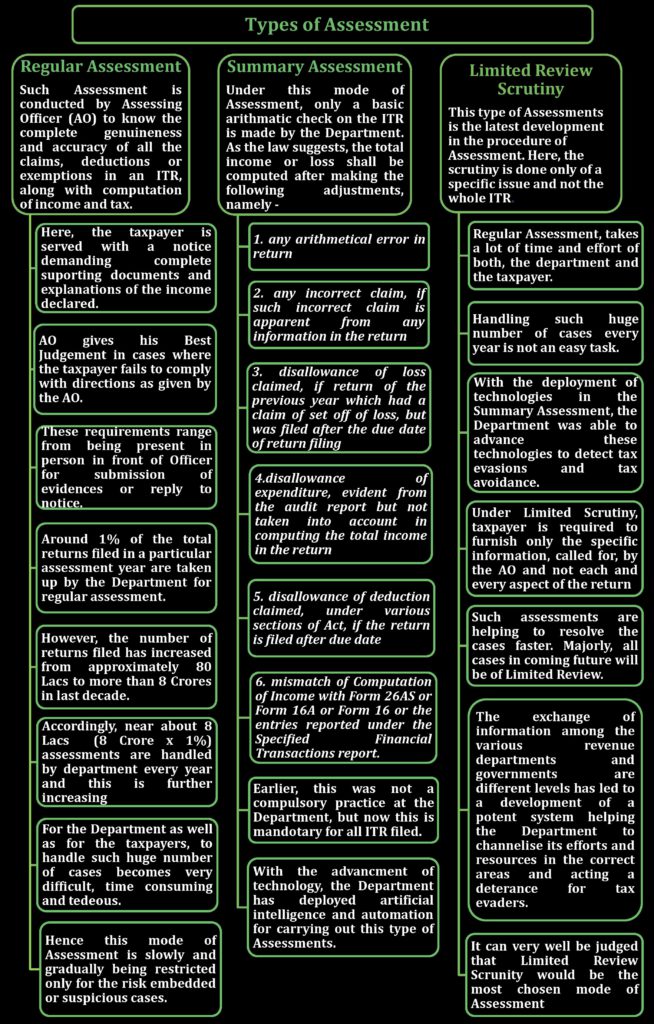

In this era of overall technological advancement, the cost of awareness is reducing day by day through readily available means of gathering and knowing information. Hence without going into much of technicalities, this article tries to make a layman understand the types and modes of assessments which has shaped itself over the last decade.

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors:

Rishabh Jain

Associate Consultant | Email: rishabh.jain@masd.co.in

Soham Dongre

Associate Consultant | Email: soham.dongre@masd.co.in