Introduction:-

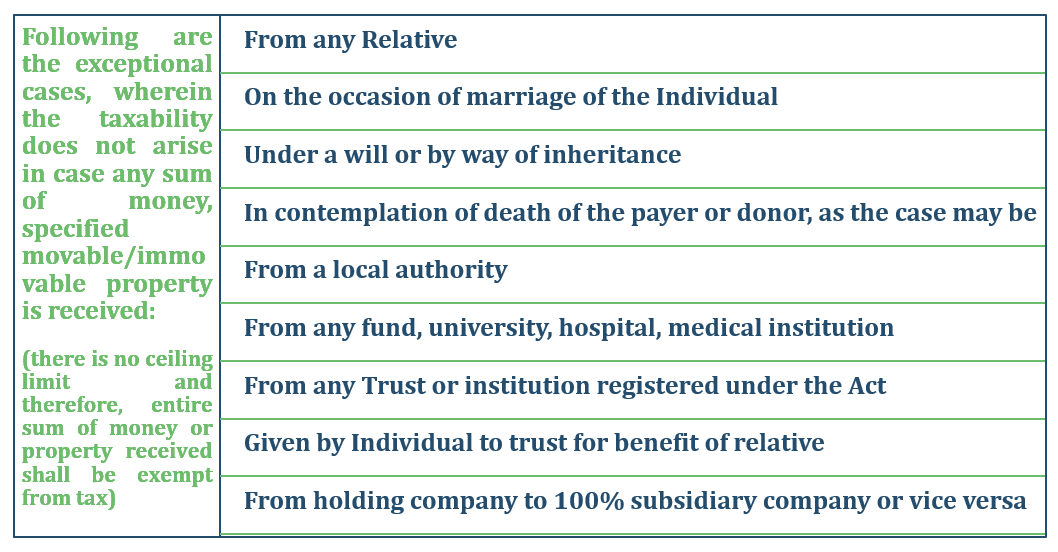

Gifts are usually capital receipts by nature. The Income Tax Act, 1961 (‘Act’) which is levies tax on incomes, that is revenue receipts, carves out certain exceptions and levies tax on capital receipts as well. Gifts are one such receipt. The Act defines gifts as any asset received without consideration like money or money’s worth (in kind). It can include Cash, movable property, immovable property, jewellery, etc. If such gifts are received from a close relative, it is not taxable. If received from others, the value if equal to less than Rs. 50,000, no tax is levied on the recipient. But if the value exceeds Rs. 50,000, the whole amount is taxable under the head “Income from Other Sources (IFOS)” as per the prevalent slab rates or rates of income tax.

Till 1st October, 1998 all gifts including gifts to relatives (barring few exceptions) were chargeable to tax under the hands of the giver under Gift Tax Act, 1957 at flat rate of 30%. Later from assessment year 2005-2006 the concept of recipient based taxation on gifts was introduced to curb the practice of tax planning/tax evasion.

Which gifts are taxed under the Act?

- Gifts received by Resident Individuals and HUF’s

- From whichever source, wherever situated

- Received wherever in the world

- Gifts received by Non-Residents / Not Ordinary Residents

- Received or deemed to be received in India

- Accrues or Arises (or is deemed to) in India

The Act provides source based taxation as well under certain cases and therefore if the source (the giver) is in India, Gift may become taxable

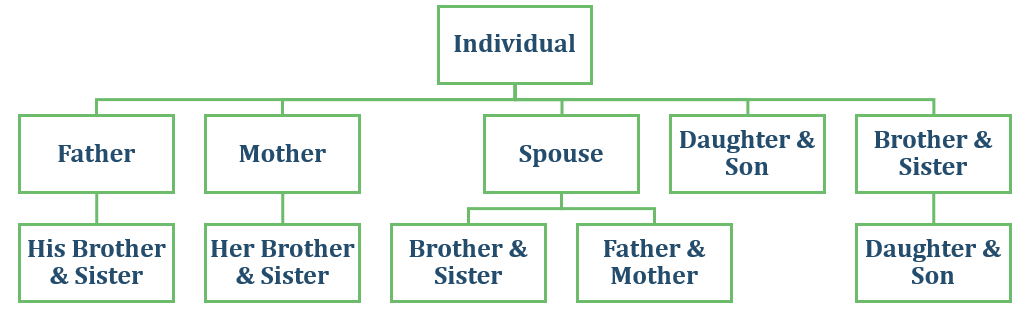

Relatives Under Income Tax Act, 1961:

“Relatives” is defined as follows in case of Individuals under the Act:

Spouse of all the above individuals are also considered as relative

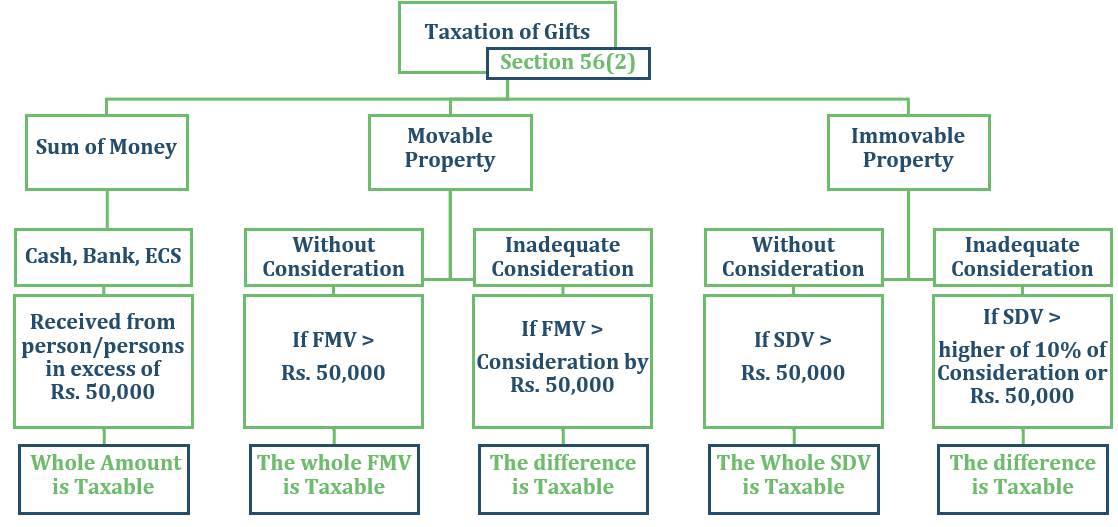

Taxation Of Gifts:

The Gifts received are usually without consideration. In certain scenarios the gifts consist of some consideration whether in money or in kind the value of which is neglible. The Act has also brought such bogus transactions in the name of gifts under taxation by introducing the term “Inadequate Consideration”. Thus any asset received from a person other than relatives for Inadequate Cosideration attracts tax under the head “Income from Other Sources” Let us understand all the scenorios of taxation under one chart:

(Note: FMV stands for Fair market value and SDV stands for Stamp Duty Value)

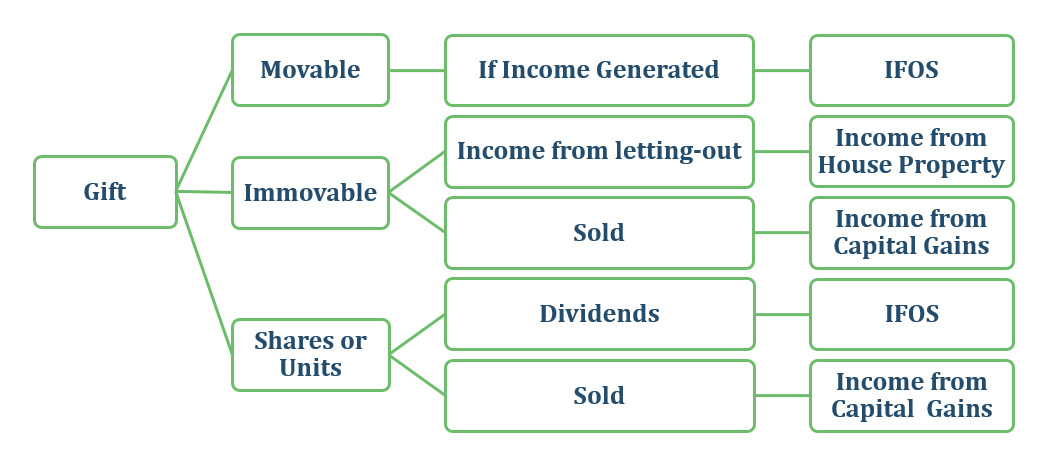

Taxability Of Income Generated From Gifts Received:

Gifts received are tax free as per the specified limits but if any income is generated from it, the same is taxable as per the respective heads of the Act. Let us understand the Income and its taxability based on the nature of assets:

Conclusion:

- All other persons such as Firm, Company, AOP’s, BOI’s are excluded from exemptions, but they can be the giver.

- Gifting won’t result in Evasion of Tax.

- Any Income arising from the Gift received is Taxable.

- A Gift Deed is highly recommended when a person wishes to gift his property or any amount of money to a relative or any other person.

- Any person beyond the definition of relative is not a relative under the Act.

- Gifts received by NRI’s are also taxable. This means that regardless of destination of the receiver, the Origin of the Gift is relevant for the purpose of Taxation in India.

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors:

Ashish Raithatha

Consultant | +91-9819911153 | ashish.raithatha@masd.co.in

Kushal Mehta

Associate Consultant | +919930612247 | kushal.mehta@masd.co.in