Introduction: –

Tax Exempt Bonds are debt securities issued by the state or local government agencies to raise money for infrastructure needs, daily operations and other projects. The interest income received on these bonds are exempt from tax to the recipient. Interest rates on such bonds are considerably low as compared to other general bonds. But this disadvantage of lower interest rates is recovered by the recipient through tax exemption on the interest income. Such features of the bonds make them well suited and attractive means of financing for the borrowers.

Eligible borrowers for Tax Exempt Bonds: –

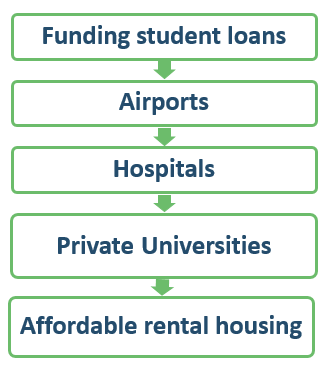

Tax Exempt Bonds have been traditionally issued by state and local governments for traditional government functions. However, other than the government, certain private organizations may also avail themselves the benefit of tax-exempt financing through state and local governmental units. These bonds are known as Private Activity Bonds (PAB) which are issued by or on behalf of the governments. PABs can be issued for projects that carry special financing benefits.

Qualified projects that can be financed through PABs are:

Types of Tax-Exempt Bonds: –

- General obligation Bonds – These bonds are not secured by any assets. Instead, the bonds are backed by the credit of the issuer. If circumstances require, the government can tax residents to get money to pay back the bond holders.

- Revenue Bonds – These bonds are secured by the revenue from the projects instead of the government’s taxing ability.

Advantages:

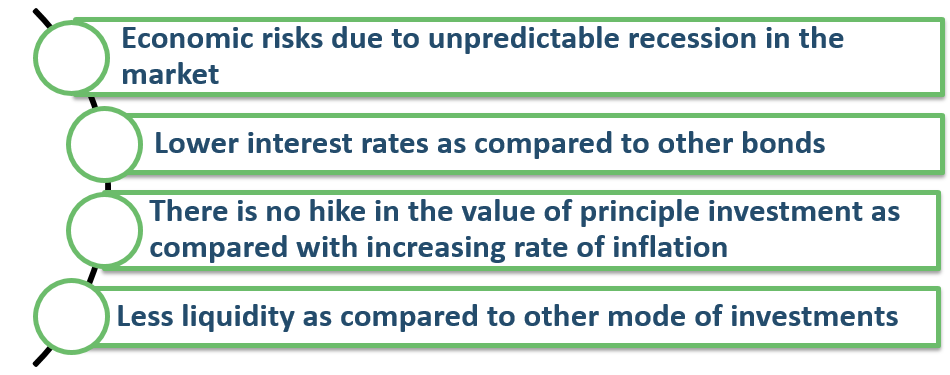

Disadvantages: –

Conclusion: –

Tax Exempt Bonds are a secure investment option to investors who seek to dilute the risk factor associated with their investment. Though the rate of interest would be low as compared to other investment options, but they can provide a relief from the burden of tax.

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors:

Parth Desai

Partner | +919819238879 | parth.desai@masd.co.in |LinkedIn profile

Kushal Mehta

Associate Consultant | +919930612247 | kushal.mehta@masd.co.in |LinkedIn profile

Shripriya Aithal

Associate Consultant |+918779984264|shripriya.aithal@masd.co.in|LinkedIn profile