INTRODUCTION:

When considering to purchase an immovable property from a Non-Resident, it’s essential to navigate through a unique set of rules and regulations. Understanding the complexities of such transactions is crucial to ensure a smooth and legally compliant process.

IMPORTANT DEFINITIONS

- Immovable property means any land (other than agricultural land) or any building or part of a building.

- Non-Resident: An individual can be termed as non-resident if his stay in India is less than 182 days in a financial year.

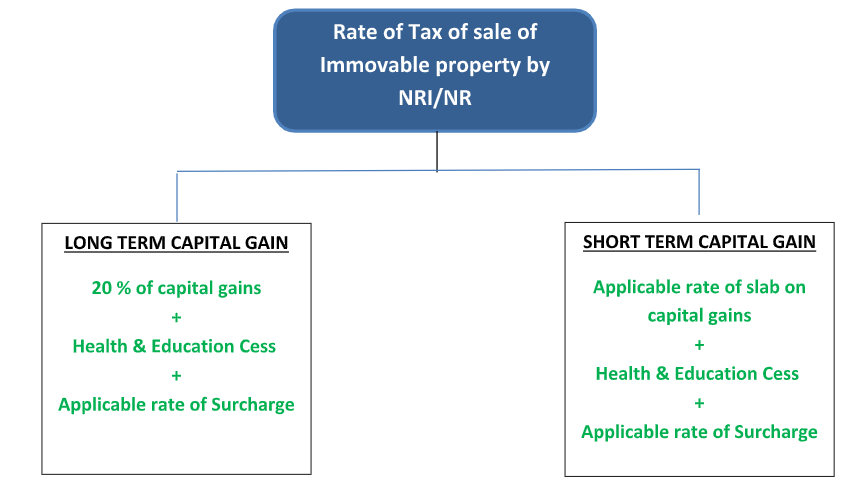

RATE OF TAX:

POINTS TO REMEMBER:

- Permanent Account number (PAN) should be available with the seller (NRI). In case if PAN is not available with the seller, then the applicable rate of tax would be 30% in addition to Health & Education Cess & Surcharge.

- The seller can also apply for the PAN number in India in order to reduce high rate of tax.

- The following table represents the effective tax rate paid by deductee/recipient in case of Long-Term Capital Gain.

Particulars | Less than 50 Lakhs | 50 LAKH TO 1 CRORES | MORE THAN 1 CRORES |

Tax Rate | 20% | 20% | 20% |

Add: Surcharge | 0% | 10% of above | 15% of above |

Total Tax including Surcharge | 20% | 22% | 23% |

Add: Health & Education Cess | 4% | 4% | 4% |

Applicable Tax Rate | 20.80% | 22.88% | 23.92% |

LOWER DEDUCTION CERTIFICATE

- A Lower Deduction Certificate (LDC) is certificate issued by the Income Tax Department in India, designed to enable the deductee (recipient) to receive income with a reduced rate of tax deduction or, in certain cases, exempted from tax deduction at the source.

- The issuance of an LDC is subject to the fulfilment of specific criteria and compliance with the established procedures outlined by the Income Tax Department.

- To apply for an LDC, the taxpayer (deductee) needs to submit a formal application in Form 13 to the Assessing Officer (AO) of the Income Tax Department. This application typically outlines the reasons for seeking a lower TDS rate. https://taxguru.in/corporate-law/deduction-certificate-lets-apply.html

- The AO will review the application and supporting documents. If he is satisfied with the request, they will issue a Lower Deduction Certificate or No Deduction Certificate specifying the reduced TDS rate or exempting the deductee from TDS.

- Now the deductor can deduct the TDS at the rate specified in the LDC by the Assessing Officer (AO)

RESPONSIBILITIES OF DEDUCTOR/BUYER

- The buyer is required to apply for Tax Deduction and Collection Account Number (TAN).

- A Tax Deduction and Collection Account Number (TAN) is a 10-digit alphanumeric identifier issued by the Income Tax Department of India to individuals, businesses, and entities that are required to deduct or collect tax at source.

- You can apply for a TAN online through the NSDL (National Securities Depository Limited) portal.

- Once the TAN number is allocated to the deductor he is required to make the payment of the TDS deducted within 7 days from the end of the month in which TDS is deducted.

- After making such payment, the buyer is also required to furnish the online Quarterly TDS statement in Form 27Q. The due dates for filing such Quarterly TDS statements have been summarised below:

SR NO | Date of ending of Quarterly F.Y. | Due date for Filing TDS Statement in Form 27Q |

1 | 30th June | 31st July |

2 | 30th September | 31st October |

3 | 31st December | 31st January |

4 | 31st March | 31st May |

6. TDS certificate i.e., Form 16A is required to be generated after filing TDS return within 15 days from the due date of submission of TDS return.

7. Form 16A serves as proof that TDS has been deducted on payment made by the deductor/buyer to the deductee/seller. It provides details of the TDS deducted and deposited with the government on behalf of the deductee.

CONCLUSION

It is pertinent to note that the procedural aspects associated with acquiring an immovable property from a resident significantly differ from those pertaining to the acquisition of immovable property from a non-resident.

In the case of acquiring property from a resident, the deductor is mandated to submit Form 26QB. This form serves the dual purpose of functioning as both a return and a challan. The applicable Tax Deducted at Source (TDS) rate for such transactions is 1% of the sale consideration.

However, the procedural requirements for acquiring property from a non-resident diverge significantly. The buyer is mandated to register as a deductor on Traces portal, pay TDS u/s 195 & file return 27Q on e-filing portal. The applicable Tax Deducted at Source (TDS) rate for the same has mentioned above.

(This article represents the views of authors only and does not intend to give any kind of legal opinion on any matter.)

Authors:

Rutwick Ruparelia

Associate Consultant |+91 9082748125 |

Email: | rutwick.ruparelia@masd.co.in |

Nitesh Jha

Manager |+91 7057907959 |

Email: | nitesh.jha@masd.co.in |

Vishal Kothari

Partner |+91 9320614111 |

Email: | vishal.kothari@masd.co.in |