Introduction

The Concept of Transfer Pricing covers transaction between the divisions or subsidiaries of Multi-National Company (MNC) located across the globe. This transaction involves expense for the receiving company and revenue for the supplying company in foreign currency. Therefore, it imbibes various aspects from costing to taxation. Transfer Pricing result in separate calculation of profits and losses within the various units of a similar organization and computation of revenue and expenses of the company as a whole. It helps in optimizing efficiency between various departments of an organization. It leads to cost sharing among the different units of an organization.

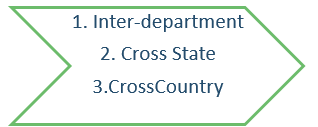

Transfer Pricing takes place when transfer of goods, services and resources is between:-

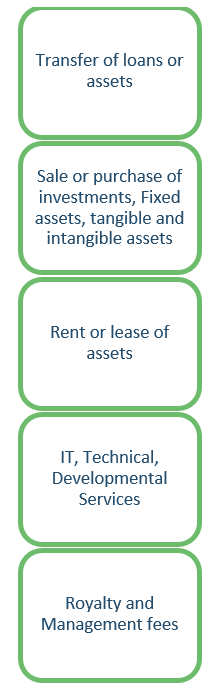

Nature of Transactions in Transfer Pricing

Reasons behind organisations resort to transfer:-

Cost Benefit:-

There are two Units within a company which are located in two different countries. Unit 1 produces two products i.e. Product 1 which is a finished product and Product 2 which is Semi finished. Unit 2 produces a semi-finished product which is sold as a raw material in the market i.e. Product 3. The cost and margin structure for products manufactured by Unit 1 and Unit 2 are mentioned below:

Illustration:-

UNIT 1 | UNIT 2 | COMPANY | |

CONTRIBUTION:- | |||

Product 1 | 30,00,000 | – | 30,00,000 |

Product 2 | 4,00,000 | – | 4,00,000 |

Product 3 | – | 3,00,000 | 3,00,000 |

TOTAL | 34,00,000 | 3,00,000 | 37,00,000 |

Less: FIXED COST | (20,00,000) | (4,00,000) | (24,00,000) |

PROFIT | 14,00,000 | (1,00,000) | 13,00,000 |

When Unit 1 sells its production in open market as stated in the above example Unit 1 and the Company as a whole earns profits but Unit 2 incurs a loss.

Now considering another situation in the continued example, Unit 1 transfers its Product 1 to Unit 2 at comparatively lower price and sells it Product 2 in the open market. Unit 2 utilizes product 1 of Unit 1 as a raw material to convert its semi-finished product to a finished one and sells its Product 3 in open market.

UNIT 1 | UNIT 2 | COMPANY | |

CONTRIBUTION:- | |||

Product 1 | 22,50,000 | – | 22,50,000 |

Product 2 | 10,00,000 | – | 10,00,000 |

Product 3 | – | 13,20,000 | 13,20,000 |

TOTAL | 32,50,000 | 13,20,000 | 45,70,000 |

Less: FIXED COST | (20,00,000) | (11,70,000) | (31,70,000) |

PROFIT | 12,50,000 | 1,50,000 | 14,00,000 |

As in the above example when Unit 1 transfers its production to Unit 2 profits are apportioned between both the units and costs are incurred with the benefit to be provided to both the units on the basis of mutual arrangement the company as well as the individual department are earning profits which lead to GOAL CONGRUENCE.

Tax Benefit:-

COUNTRY 1 | COUNTRY 2 |

Tax Rate = 20% | Tax Rate = 30% |

Arm’s Length Sale Price = $100000 | Arm’s Length Sale Price = $100000 |

Tax Amount = $20000 | Tax Amount = $30000 |

Own Price = $150000 | Own Price = $150000 |

Tax Rate = 20% | Tax Rate = 30% |

Tax Amount = $30000 | Tax Amount = $45000 |

Transfer pricing leads to tax savings for organizations. Companies widely use this practice to reduce to burden of tax on them. They charge a higher price to related parties in countries with high tax rate to reduce profit, while charging a lower price for increase of profit in the countries with low tax rate. To ensure that there is no avoidance of tax in the country the government has introduces laws, rules and regulations relating to domestic and international transfer of goods and services.

Transfer pricing regulations in India (Direct Tax Implications):-

Transfer price is calculated on arm’s length price. Arm’s length price is a price at which trading of goods takes place between unconnected companies. Unconnected companies are independent entities having only commercial financial relations where price is a sole consideration.

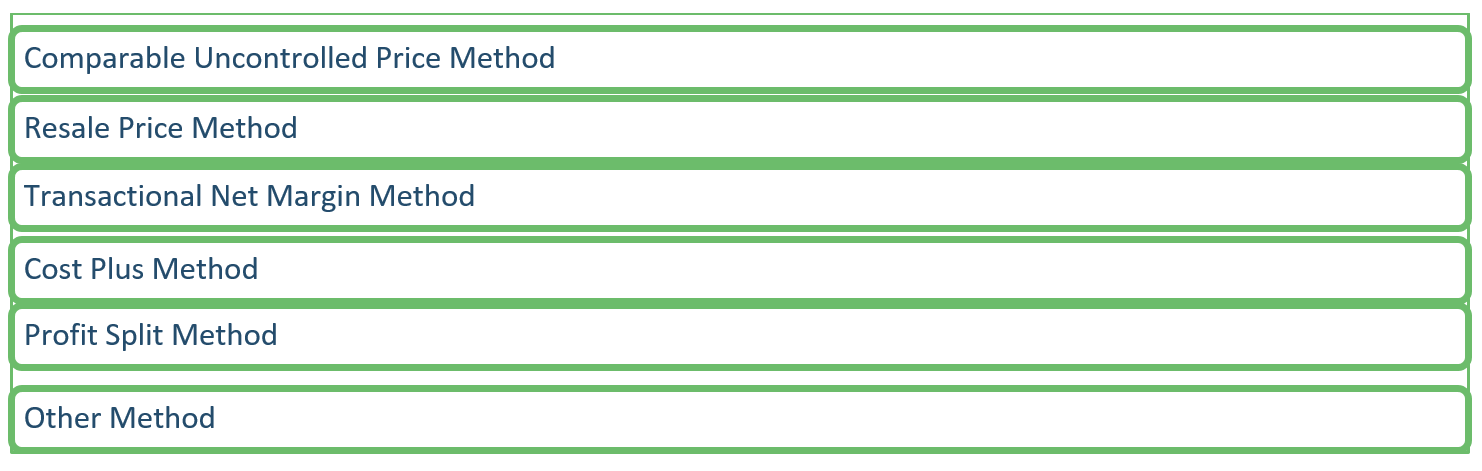

Methods to compute Arm’s length price are as follows:-

If there is more than one price determined by any of the above method average of such price shall be the arm’s length price. If the transfer amount charged by the assesse is more than the arm’s length price, then income tax @20% would be charged to the assesse on the money in excess of the arm’s length price if excess money is not repatriated.

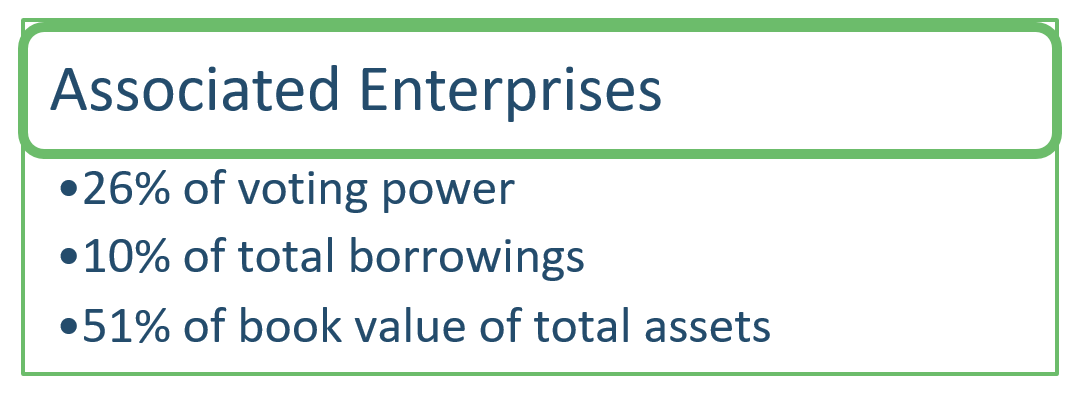

International Transaction in transfer pricing is a transaction where one party must be a non-resident and transaction must be between Associated Enterprises. Associated Enterprises means an enterprise who directly or indirectly participates in shareholding, control and management of other enterprise as below

Assesse entering into a transfer pricing international transaction is required to maintain documents as specified by CBDT. The transfer pricing documentation shall be required if the value of international transactions exceeds INR 1 crore and specified domestic transactions exceed INR 20 crore in a financial year. The documentation should be maintained for a period of 8 years from the end of the assessment year to which the Documentation relates.

Assesse is required to file a report of a Chartered Accountant with a return of income about international transactions up to 31st October of Assessment Year in form No. 3CEB.

Due date of return filing of transfer pricing is 30th November of Assessment Year

Interplay of Transfer Pricing and GST

Contradictory views between the Income tax Department and GST Authority

To increase the Income tax liability in India, Income tax department would like to determine Arm’s Length price of expenditure at the lower side as it would increase the profits of Indian Entity. Whereas, to increase the collection of GST on Import of Service, the Goods and Service Authority would like to determine Arm’s Length price at the higher side.

For Eg-

Foreign Companies allow their Indian Subsidiary to use their License on Free of cost basis which is a non-monetary transaction. So these transactions are not recorded in books of accounts

According to CGST Act, 2017, supply between related parties without any consideration is considered as taxable supply on which GST is applicable.

However, Income Tax authority may rely on valuation carried out for GST purpose as Arm’s Length price and can demand deduction of TDS.

Conclusion

The governments of all the countries across the globe are trying to derive standard laws, rules and regulations on Transfer Pricing for all the countries which would not result in revenue loss and tax avoidance in countries with higher tax rate. Due to the overlapping laws of GST and Transfer Pricing, it is not only difficult for the tax authority but also for the business professionals at times to comply with.

Author

Krishna Makwana

Associate Consultant | +918104510188 | krishna.makwana@masd.co.in | LinkedIn Profile