In India, institutions set up for social causes and approved by the Income Tax Department get not only exemption from tax payment but also the donors to such trusts can deduct the amount of donation to the trust from their taxable income. Companies formed under Section 8 of the Companies Act 2013 for promoting charity also receive benefits under the law, including exemption from various procedural provisions of the Companies Act, either wholly or in part, and are also entitled to such other exemptions that the Central Government may accord through its orders. Charitable institutions have to comply with multiple statutory filings, reporting and audits.

To know more about charitable institutions, refer article:- Article

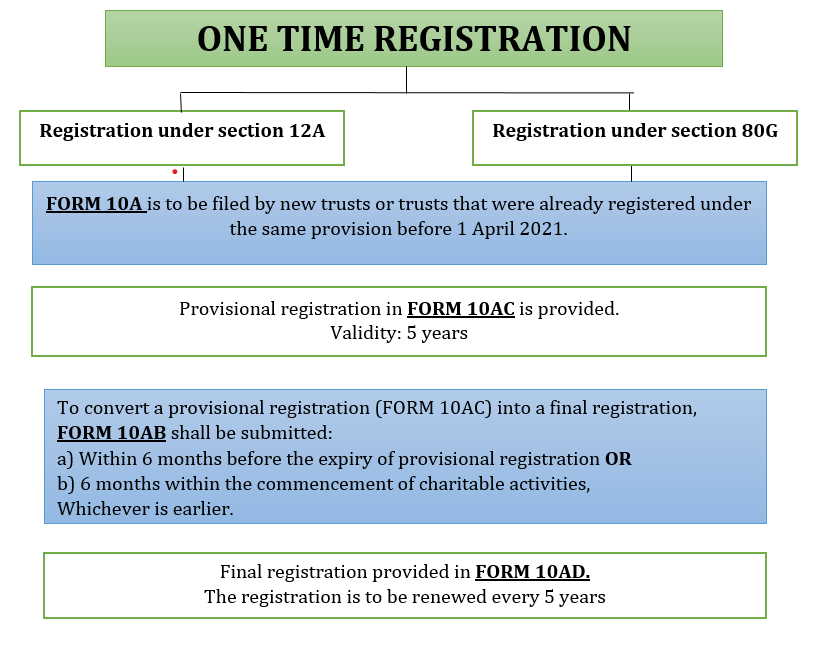

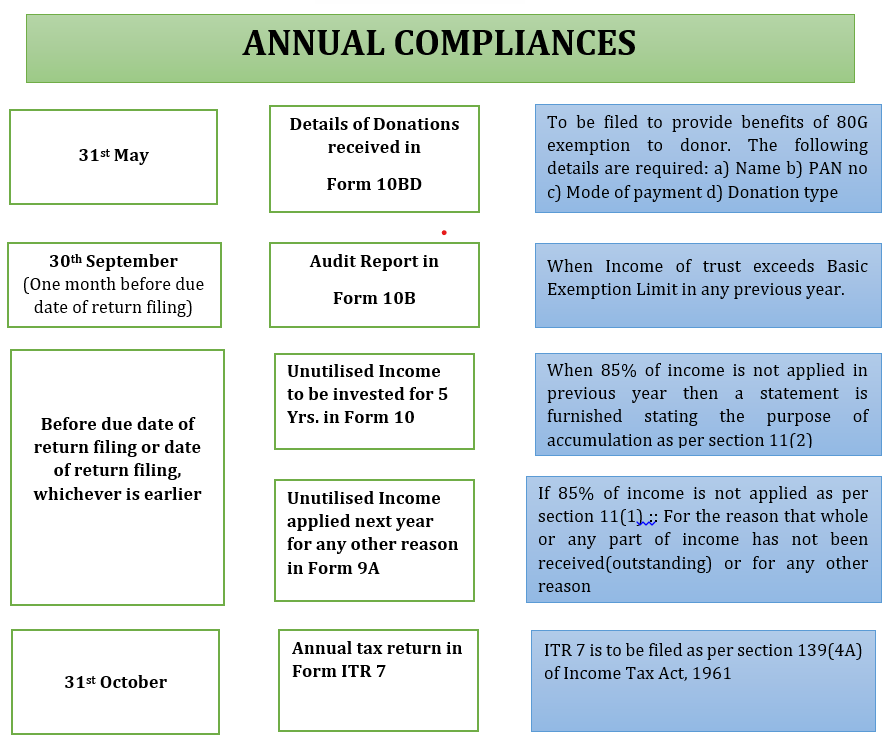

This article looks into compliances under section 12A, 80G with amendments effective from the Financial year 2021-22 & various annual compliances within the ambit of the Income Tax Act, 1961 (‘Act’).

Charitable Trusts enjoy various exemptions under the Act so that the donations and funds received by them are wholly utilized for social and charitable purpose. However, these exemptions come with few governances in the form of additional tax reporting. Utmost precaution shall be taken by the Trusts to ensure timely and complete tax reporting to function smoothly.

Authors:

Shreyans Dedhia

Partner | Email: shreyans.dedhia@masd.co.in | LinkedIn Profile

Kirtan Patel

Associate Consultant | Email: kirtan.patel@masd.co.in |LinkedIn Profile

Vishwa Dhruv

Associate Consultant | Email: vishwa.dhruv@masd.co.in | LinkedIn Profile