I. Introduction:

With the intention of taxing the digital transactions arising from increasing globalization-digitalization and industrial revolution, Equalization Levy was introduced in India in 2016 by Finance Act 2016. India is the first country to charge such a levy.

Chapter VIII of the Finance Act, 2016 provides for Equalization levy (EL 1.0) as a direct tax at the rate of 6% of the consideration payable or paid for any specified service in excess of Rs. 1,00,000/- in a financial year to a person, being a non-resident and paid by a person resident in India or a non-resident having Permanent Establishment (PE) in India. For further details on EL 1.0 one can refer to our article ‘Equalization Levy’ at https://masd.co.in/income-tax/equalization-levy/ )

II. Expansion of Scope by Finance Act (2020):

The scope of the Equalization levy was expanded by the Government of India in the Finance Act, 2020 in order to include the supply of goods and/or services given by an e-commerce operator. The Equalization levy is levied at the rate of 2% on any amount received or receivable by an E-commerce operator from an e-commerce supply of service made or provided

a. to a person resident in India; or

b. to a non-resident in the specified circumstances (as discussed below); or

c. to a person who buys such goods or services or both using an internet protocol address located in India.

Here “Specified circumstances” means

- Sale of advertisement which targets a customer, who is a resident in India or a customer who accesses the advertisement through an IP address located in India; and

- Sale of data, collected from Indian resident or from a person who uses an IP address located in India

III. E-commerce Supply of Services means:

- Online sale of goods owned by e-commerce operator; or

- Online provision of services provided by the e-commerce operator; or

- Online sale of goods or provision of services or both, facilitated by the e-commerce operator; or

- Any combination of the above-mentioned activities.

Here E-commerce operator means a non-resident who owns, operates or manages digital or electronic facility or platform for online sale of goods or online provision of services or both.

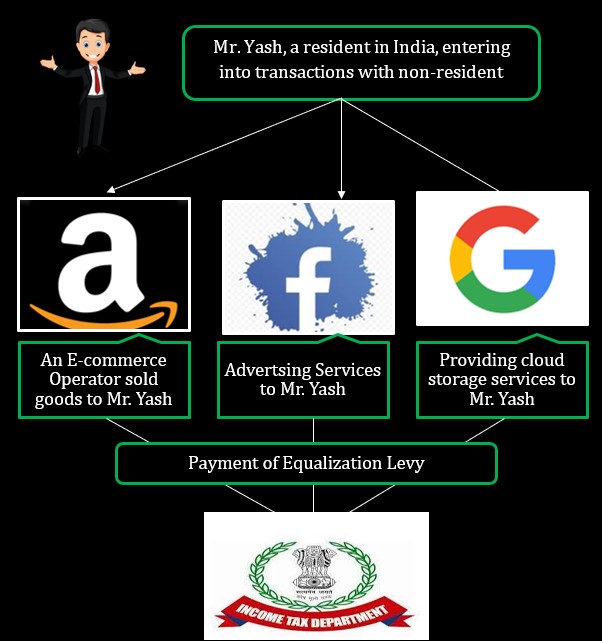

Consider the following example,

- Yash a resident in India orders goods from Amazon.com who is non-resident. Amazon.com needs to pay equalization levy on the amount of goods sold to Mr. Yash.

- If Amazon earns Rs. 20 Crores as Amazon Prime subscriptions from the persons as discussed in point II above, then Amazon needs to deposit Rs. 40 lakhs as Equalisation Levy to the credit of Indian Government being 2% of Rs. 20crores.

- Cloud storage services provided by non-resident companies like Google and Amazon shall also fall under the purview equalisation levy.

- Online gaming services are also included in the ambit of the equalisation levy.

IV. Non-applicability of Equalisation Levy in the following instances:

- Where an e-commerce service provider has a permanent establishment in India and the service provided is effectively connected with such permanent establishment.

- Where the sales/turnover or gross receipts of service provided by e-commerce operator does not exceed Rs 2 Crores during the year.

V. Due Dates for payment:

Equalization Levy shall be paid by every e-commerce operator to the Central Government on a quarterly basis as per the following schedule.

Furnishing of Statement:

Every Assessee or e-commerce operator shall furnish a statement in respect of all services provided by them to the Assessing Officer or any other person authorized by the Board within 30th June immediately following the financial year.

If an assessee notices any omission and wants to revise the statement furnished earlier the same can be revised within 2 years from the end of the financial year in which the return was filed.

VI. Penalty-Late fees & Interest:

- Interest is charged at 1% of the outstanding levy for every month or part thereof is delayed.

- If Equalization Levy is not deducted, a penalty equal to the amount of levy failed to be deducted.

- If Equalization Levy is deducted but the not deposited penalty will be Rs. 1,000 per day maximum to the amount of the levy.

- The penalty for late filing of the Statement is Rs. 100 per day till the non-compliance continues.

VII. Conclusion:

In order to broaden the scope of the Equalization levy beyond online advertisement, the Government extended the scope in the Finance Act, 2020 and included a tax on goods and/or service received or receivable from an e-commerce operator with effect from 1.4.2020. To summarize, at present, the said levy includes the following:

- Advertising Services @ 6% payable by service receiver;

- E-commerce supply of goods or services @2% payable by the e-commerce operator.

It was anticipated that the scope of this levy would further widen in Finance Act, 2021 or Finance Act, 2022, but no such amendments were made.

(This article represents the views of the firm only and does not intend to give any kind of legal opinion on any matter)

Vishal Kothari

Director | vishal.kothari@masd.co.in