Introduction:-

A New Section 140B has been inserted in Direct Taxation by Finance Minister in the Budget 2022 for the tax to be paid to file a return under the proposed provisions i.e. Section 139(8A) of Income Tax Act. As per this new clause, a Taxpayer will be allowed to file an “Updated Return” to file Pending Return or correct the Omissions and Errors that are reported in the Original Return. The Time limit for filing the Updated Return is within two years from the end of relevant Assessment year.

Example: – The due date for filing Updated Return for F.Y.2022-23 i.e. A.Y.2023-24 will be 31st March, 2026.

The above amendment will come into effect from 1st April, 2022.

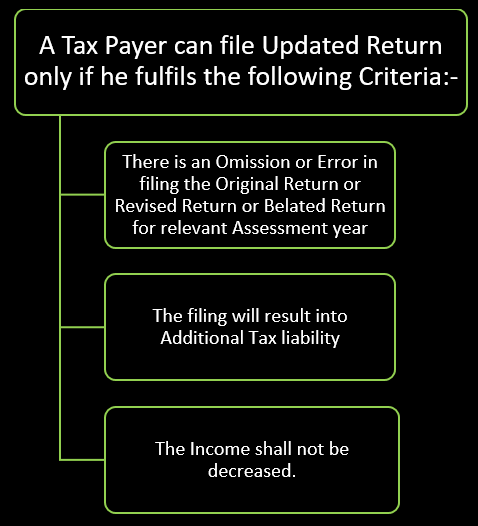

Eligibility:-

Restrictions:-

A Tax Payer shall be restricted from filing Updated Return as per Section 139(8A) if:-

- The updated return has been furnished for the relevant assessment year, OR

- If there is any on-going or completed proceeding for Assessment or Reassessment or Recomputation or Revision of Income under Income Tax Act for relevant Assessment Year, OR

- The Assessing Officer has information in respect of the Tax Payer for the relevant Assessment Year in his possession under the Prevention of Money Laundering Act, 2002 or the Black Money ( Undisclosed Foreign Income and Assets ) and Imposition of Tax Act, 2015 or the Provision of Benami Property Transaction Act, 1998 or The Smugglers and Foreign Exchange Manipulators (Forfeiture of Property) Act, 1976 and the same has been communicated to the Tax Payer prior to the date of filing the Updated Return, OR

- If any information for the relevant Assessment Year under section 90 or 90A(DTAA) has come to the notice of Assessing Officer and the same has been communicated to the Tax payer before filing of Updated Return, OR

- If any proceeding for Offences or Prosecution under Income Tax Act, 1961 have been initiated for the relevant Assessment Year prior to filing the Updated Return, OR

- If he is such other person, as may be notified by the Board in this regard.

Penalties For Filing Updated Return:-

The Penalties for filing Updated return depends upon the period in which it is filed. This can be understood from the following:-

- If the return is filed within 12 months from the end of relevant Assessment Year, the Taxpayer would be liable to pay a penalty which will be equal to 25% of total tax to be paid in updated return and interest thereon OR

- If the return is filed after 12 months but before completion of 24 months from the end of relevant Assessment Year, the Taxpayer would be liable to pay a penalty which will be equal to 50% of total tax to be paid in updated return and interest thereon.

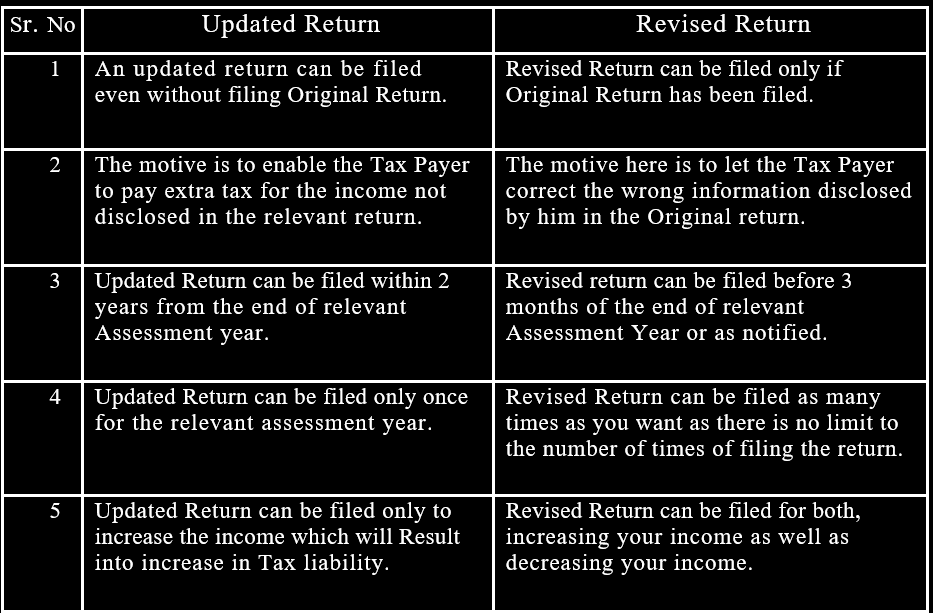

Difference between Updated Return and Revised return:-

Points to be taken in Consideration while filing Updated Return:-

- In view of the proposed Sub-Section (8A) of section 139, New Section 140B, consequential amendments in Section 144 (Scrutiny Assessment), Section 153 (Assessment in case of Search and Seizure), Section 234A (Interest for delay in Filing return), Section 234B and 234C (Interest related to Payment of Advance Tax) and 276CC (Imprisonment in case of failure in filing the return) have also been made.

- A Taxpayer shall keep in mind that he won’t be eligible for any refund if opting for Updated Return.

- While filing Updated Return, the Interest and Late fees will be applicable as it is in normal cases, but it will also include an additional liability which is mentioned above under the Penalties head.

Objective of Introducing Updated Return:-

To enable the Tax Payer to file return even if the dates have been passed, by giving extra time to file.

If the Tax Payer has missed out the disclosure of certain Income which might result in proceedings then he can file the updated return in order to escape from getting into the compliance work of proceedings.

The Updated return will not only save a Tax Payer from Proceedings, but also from any consecutive types of litigation

If the Tax payer has missed out to file an Income Tax return of 2 years back from applicable Assessment Year, then he can still file it in the form of updated return.

The Updated Return will enable the Government to have a proper knowledge on the potentiality of the income which can be generated by a Tax Payer.

The Updated Return will work as a source of Additional Tax Income for the Government.

By means of Updated Return, the Plan of the Government to terminate the Tax Evasion will get a kick-start.

Note: – The Information provided above is as per the Finance Bill which was introduced during the Budget 2022. The Finance Act is yet to come, so changes may be expected with relation to the Finance Act, 2022.

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors:

Kushal Mehta

Associate Consultant | +919930612247 | kushal.mehta@masd.co.in

Mihir Jain

Associate Consultant | +919821700600 | mihir.jain@masd.co.in