Introduction:

Having effective internal controls is one of the most vital aspects of any organization’s operation. Among organizations that need effective operating internal controls, Charitable Institutions are found to be at the top of the list because they are administered and function by different third-party stakeholders to serve the ultimate needs and goals of numerous participants or beneficiaries.

Contributions & benefit payments, Treasury & investment management, financial reporting, and compliance are the key activities that any Charitable Institution would have and, accordingly, internal controls over these key activities need to be maintained effectively.

Illustrative Internal Controls for the above-mentioned key activities are explained below:

Contribution & Benefit Payments:

- The revenue that a Charitable Institution earns from its operations should be within the object of the Charitable Institution.

- Charitable Institutions should do expenditure only for fulfilling the objects of the Charitable Institution.

- Cash Donations are allowed to be accepted only up to Rs. 2,000 per person.

- As per Income Tax Act, 1961 as amended by Finance Act, 2021 every Charitable Institution who is holding an active Section 80G registration certificate is supposed to furnish details of all the donors to the Income Tax Department annually. The details of donors consist of the following:

- A separate register for Donations shall be maintained. It should be updated and checked regularly.

- If a Charitable Institution has received any corpus donation for a specified purpose, make sure that the funds are utilized only for the specified purpose or added to the corpus.

- Ensure relevant Letters/ Agreements for Earmarked Funds / Sponsorship / CSR are documented.

- In the case of a Government Grant, ensure timely reporting of expenditure is made over the PFMS portal.

- In case any Utilisation Certificate is required to be submitted for any Grant, ensure the same is submitted promptly.

- The proper tracker should be maintained to ensure goals/ objectives/ milestones under various grants/ CSR is achieved on a timely basis.

Treasury & Investment Management:

- Surprise Cash Verification should be conducted.

- A proper cash register should be maintained. Cash transactions over INR 5,000 should be restricted.

- A proper Authorisation matrix should be implemented for banking transactions.

- Set a threshold of the amount to be maintained under liquid assets like cash/ bank balance. Invest the excess amount in fixed deposits or Mutual Funds.

- In case it has made investments in Fixed Deposits, it shall maintain a Fixed Deposits Tracker which shall be updated and reconciled regularly.

- Interest earned on the Fixed deposits made shall be reconciled.

- For charitable institutions claiming exemption under Income Tax Act, investments shall be made as per section 11(5) of the Income Tax Act.

- Few areas where a Charitable Institution can make investments, subject to specified limits, are as follows:

Financial Reporting and Compliance:

- Ensure registration is obtained u/s 12A and u/s 80G before accepting Donations. The same should be timely renewed.

- Donation-related returns should be filed as per Income Tax Act promptly.

- Anonymous donations, though can be accepted, would entail tax liability.

- Ensure registration under FCRA is obtained before accepting any foreign currency donations. FCRA registration can be obtained once the expenses on the objects of Charitable Institution exceed INR 15,00,000/-

- Separate bank accounts and separate books of accounts are required to be maintained for accepting Foreign Currency donations.

- All Physical Documents such as Purchase Vouchers, Sale Invoices, etc. should be duly stamped by an accountant in charge.

- In case Charitable Institution has any business activity which is taxable under GST, it should obtain registration once the total turnover exceeds the threshold.

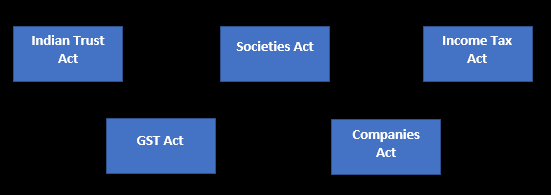

- Other Statutory compliance that a Charitable Institution needs to comply with are as follows:

Authors:

Shreyans Dedhia

Partner | Email: shreyans.dedhia@masd.co.in

Urvesh Shah

Associate Consultant | Email: urvesh.shah@masd.co.in