Introduction: –

We all have heard about the fake GST registrations being taken for the sole purpose of tax evasion. The fake GST registrations are taken in the name of non-existent tax payers or on behalf of the less economical individuals by defrauding them. Fake invoices are raised in order to shift the tax burden from one entity to another. Over the years, after the introduction of the GST Act, there were many cases where the government has investigated and taken action for the same.

But for the first time, the CBIC is launching a Special All India Drive for exclusively investigating fake GST registrations. Special All India Drive will be conducted by the Central and State tax administrations over two-month period between 16th May 2023 and 15th July 2023. Due to many taxpayers involved in thousands of crores of GST invasion, which is being unveiled by the department, this step has been taken to restrict fake registration and eliminate the fake billers from the GST eco-system.

Identification of fake GSTIN: –

- Identification of suspicious GSTIN potentially involved in fraudulent activities will be concluded through tools like detailed data analytics and risk parameters by Goods and Service Tax Network (GSTN).

- Post identification, the information will shared to Central and State Tax authorities. And in case of Central Tax authorities, the information of the suspicious GSTIN will be communicated through the Directorate General of Analytics and Risk Management (DGARM).

- The drive will then be conducted by the concerned Tax authorities and the necessary actions will be taken based on the survey conducted by them.

- Further, human intelligence, aadhar database, local knowledge and experience based on past detection will also be used as tools to broaden the identification process.

The specifics of the drive and the actions that would be consequently be taken by the authorities are further explained below.

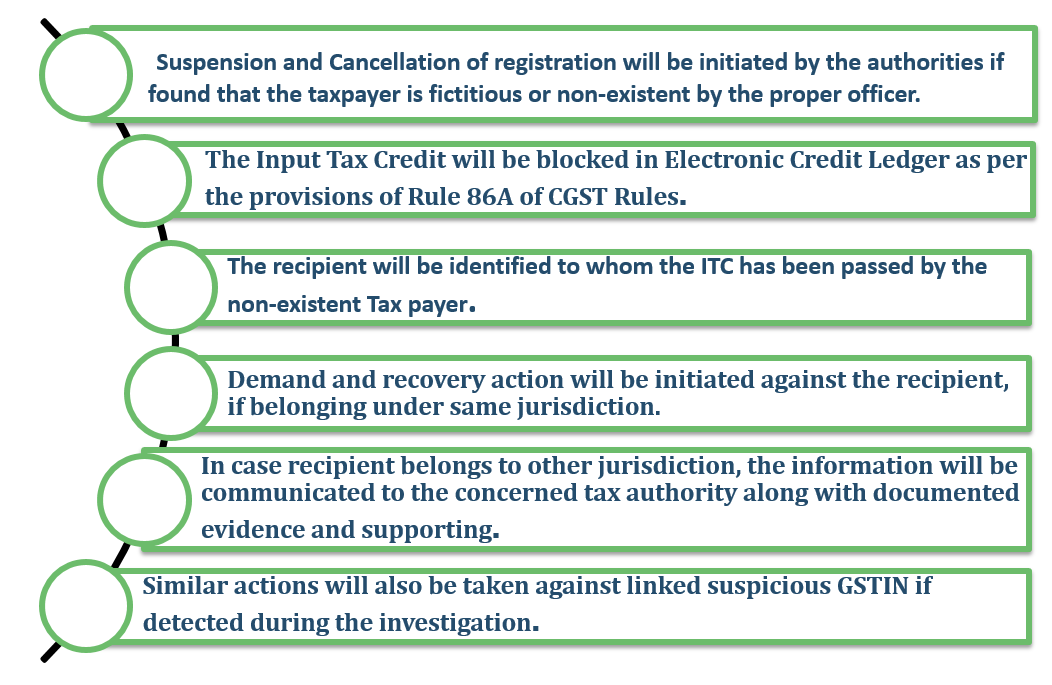

Action by Tax Authority: –

The Tax Authorities will conduct a time bound GSTIN verification once the information is received after identification. Suitable action will be taken by the authorities post investigation. The actions can be any of the following mentioned below:-

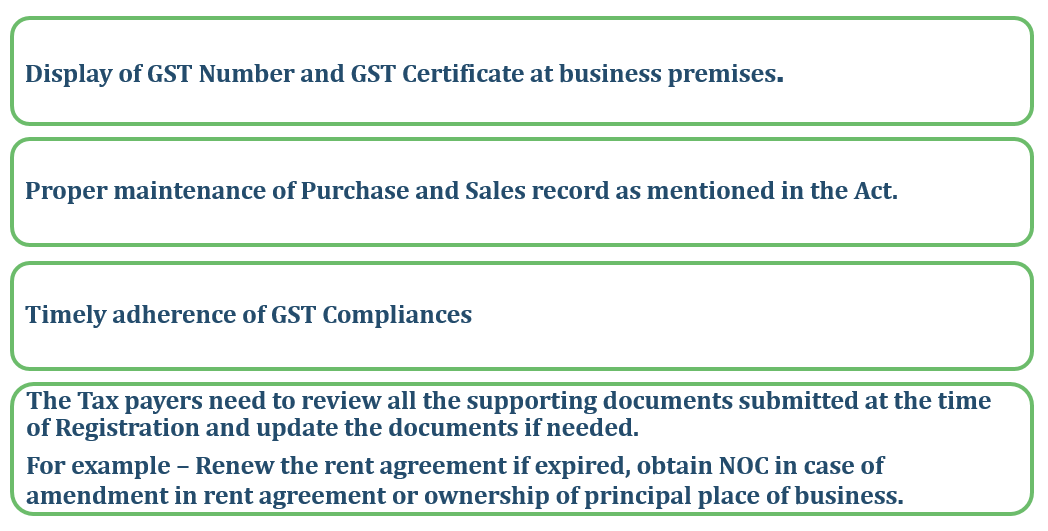

Action by Tax Payer:

Conclusion: –

The Special Drive to be conducted by the authorities will play a pivotal role in restricting fake GST registrations and will help in curbing the tax evasion committed through this practice. And inspite of all the precautions taken by the government at the time of registrations, the cases have increased and the tax evasion has doubled over the last few months.

This investigation is to decode the existence and the reality of the GST numbers as received by the GSTN based on their survey. There is no need for the genuine tax payers to panic as the primary objective of the government is the identification and eradication of fictitious tax payers. Active participation can help in contributing towards a transparent and accountable GST system.

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors:

CA Hardik Patel

Partner| +919870738130 | hardik.patel@masd.co.in |LinkedIn profile

Shripriya Aithal

Associate Consultant |+918779984264|shripriya.aithal@masd.co.in|LinkedIn profile