As per Section 9(5) of the CGST Act, Electronic Commerce Operator (ECO) is required to pay tax on the supply of services such as Accommodation services, Housekeeping Services, and Passenger Transport services if such services are supplied through ECO.

However, it has been notified under section 9(5) of the CGST Act, 2017, the ECO shall be liable to pay GST on restaurant services provided, with effect from the 1st of January 2022, through ECO. Accordingly, the ECOs will no longer be required to collect TCS and file GSTR 8 in respect of restaurant services on which it pays tax in terms of section 9(5). On other goods or services supplied through ECO, which are not notified u/s 9(5), ECOs will continue to pay TCS in terms of section 52 of CGST Act, 2017 in the same manner at present

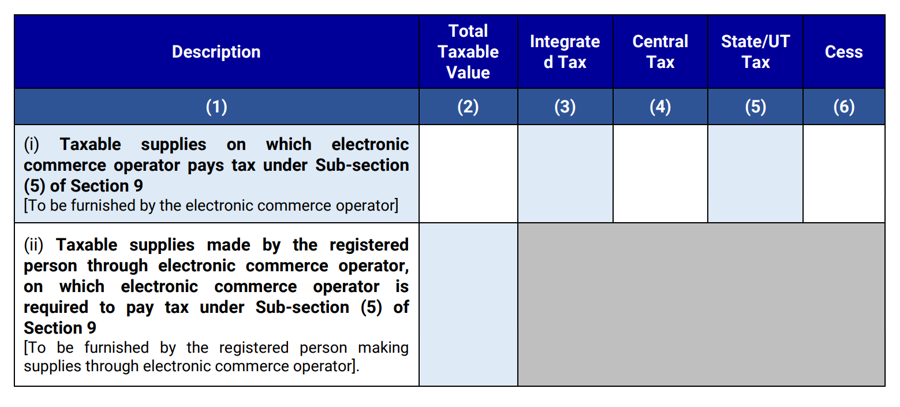

For the Ease of differentiation between the sales through E-commerce and Normal Sales, A new Table 3.1.1 has been introduced as per Notification dated 05th July 2022 and has been made available on the GST portal from 1st August 2022 in GSTR-3B where both ECOs and registered persons can report supplies made under Section 9(5) as mentioned below.

From the format of Table 3.1.1, the following is noteworthy

- An Electronic Commerce Operator is required to report outward supplies made u/s 9(5) in Table 3.1.1 (i) of GSTR-3B and shall exclude such supplies in Table 3.1(a) of GSTR-3B.

- The applicable tax on such supplies shall be paid by ECO in Table 3.1.1(i) of GSTR-3B in cash only and not by ITC.

- A registered person who is making supplies of such services as specified u/s 9(5) through an ECO, shall report such supplies in Table 3.1.1(ii) and shall not include such supplies in Table 3.1(a) of GSTR-3B.

- The registered person is not required to pay tax on such supplies as the ECO is liable to pay tax on such supplies.

- Transactions are to be reported in Table 3.1.1 by ECOs and registered persons, only in the case of the following services:

- Passenger transport service

- Housekeeping Services

- Accommodation services

- Restaurant services

With the recent changes, ECO’s and registered person who is making supplies through ECO must consider the above changes before filing their returns from August 2022 to avoid any scrutiny letter from the department.

Authors:

Prashant Taparia | Partner | +91 90295 07606 | prashant.taparia@masd.co.in |LinkedIn Profile

Mihir Jain | Associate Consultant | +91 98217 00600 | mihir.jain@masd.co.in |LinkedIn Profile

Kalp Lodha | Associate Consultant | +91 83694 19320