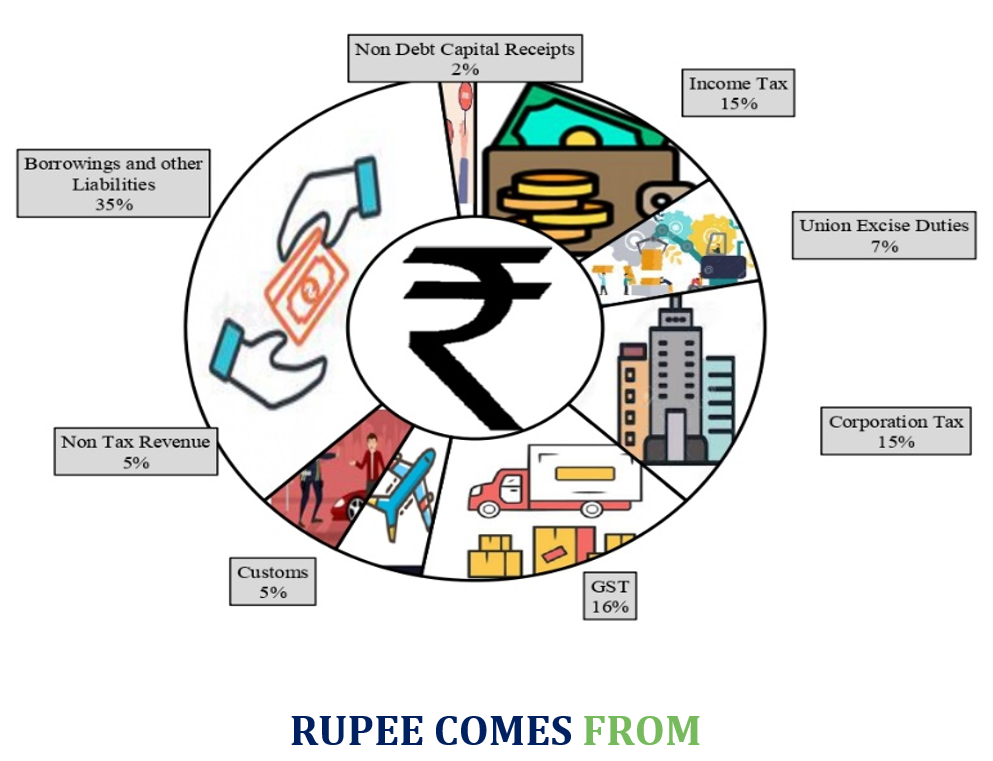

Source for Expenditure (Estimates):

Sr. | Sources | Amount (in Lakh Crores) | Percentage |

1 | Corporate-Tax | 7.20 | 18% |

2 | Income-Tax | 7.00 | 18% |

3 | Customs Duty | 2.13 | 5% |

4 | Union Excise Duties | 3.35 | 8% |

5 | Goods & Service Tax | 7.83 | 20% |

6 | Non Tax Revenue | 2.69 | 7% |

7 | Non-Debt Capital Receipts | 0.79 | 2% |

8 | Borrowings & Other Liabilities | 8.45 | 22% |

Budgeted Expenditure | 39.44 Lakh Crores | 100% | |

The Fiscal Deficit shot up to 6.9% of GDP for FY21-22 on account of the COVID-19 pandemic.

PROPOSED AMENDMENTS UNDER FINANCE BILL, 2021

A. TAX & COMPLIANCE

1. DIRECT TAX

o INCOME TAX

- Any gains arising from sale of Virtual Digital Assets (NFT’s & Crypto currency) will be taxed at a special rate of 30%, also no deductions for expenses other than cost of acquisition will be allowed.

- Any losses from sale of Crypto currency will not be set-off against any other head of Income;

- Any kind of Gift received in Crypto currency will be taxed at the hands of the receiver.

- TDS at the rate of 1% will be applicable on the transfer of Virtual Digital Assets above an amount of 10,000/- in case of non-specified persons. However, in case of specified persons the limit will be Rs. 50,000/-

- Start-ups established before 31st March 2023 (earlier- 31.03.2022, now extended by 1 year) will be provided with tax holiday of 3 years;

- Last date for commencement of Manufacturing Business for claiming lower tax regime u/s 115BAB will be 31st March 2024 (earlier- 31.03.2023, now extended by 1 year);

- If Undisclosed Income detected during ‘Search’, no deduction will be allowed on such additional income;

- Surcharge on Long Term Capital Gains on any asset will be capped at 15%;

- Health & Education Cess and Surcharge shall not be allowed as Business Expenditure;

- Provision for filing ‘Updated Return’ with payment of additional tax within 24 months from the end of relevant assessment year in case of any omission or mistake;

- Tax relief for persons with disability: Allow annuity payment to differently abled dependents when parents attaining age of 60 years;

- Reduced Alternate Minimum Tax (AMT) rates for Co-operative Societies from 5% to 15%;

- Reduction in surcharge from 12% to 7% for Co-operative Societies with total income of 1 crore to 10 crores;

- Deduction for National Pension Scheme (NPS) for State Government employees u/s 80CCC made at par with Central Govt.

- Better litigation management to avoid repetitive appeals;

2. INDIRECT TAX

o GST

- The Gross GST Collection touched the all-time-high from its inception due to rapid economic recovery post Covid-19. The Gross GST Collection in January 2022 equals 1,46,986 crores.

o CUSTOMS

- To give a boost to the Gems & Jewellery sector, Custom Duty on cut and polished diamonds and gemstones is being reduced to 5% from 7.5%. Simply sawn diamond would attract NIL Customs duty;

- Custom Duty on Imitation Jewellery will be atleast 400/kg on its import;

- Custom Duty on Umbrellas is being raised to 20%;

- Unblended fuel to attract additional excise duty of Rs.2/litre from October 1 to promote blending biofuels in petrol and diesel;

- Customs duty cut on certain chemicals including Methanol to promote domestic manufacturing.

- Certain anti-dumping duties and countervailing duties on certain steel products are being revoked due to high prices;

3. KEY POLICY ANNOUNCEMENTS

- Digital Rupee to be issued using blockchain and other technologies; to be issued using by RBI starting 2022-23.

- Issuance of E-passports will be ruled out in 2022-23 to enhance convenience for citizens.

- No Changes in Slab rates for Individuals & others;

- India Economic Growth in FY22 to be at 9.2%.

Economic Growth estimated at 9.2%.

- MSMEs such as Udhyam, e-shram, NCS & Aseem portals will be interlinked, their scope will be widened, providing G-C, B-C & B-B services.

- 5 lakh post offices to be connected to core banking.

- To reduce the delay in payment, an online bill system to be launched which will be used by all Central Ministries.