INTRODUCTION

An Employee Share Based Payments (ESBPs) is an employee benefit payment that gives employees an ownership interest in the company. Under these plans, the employer gives certain stocks of the company to the employee for negligible or less cost which remain in the ESBP fund, until the options gets vested and the employee exercises them

WHY ESBPs?

- Employee share based payments (ESBPs) are effective ways of incentivizing employees

- ESBPs work as a two way growth strategy for both company as well as the employees

- Considered vital in enabling business to attract, retain, motivate and reward human resources

- Works as catalysts for the employee’s growth as well as the growth of the company

- Helps the employees to participate in the entity’s growth

- Helps entities to boost the growth rate and align vision of employees with that of company

- Employee has the opportunity to participate in the wealth creation of the company

This article revolves around the components and taxation aspects of different types of ESBPs. Before we proceed further, let us have a quick understanding about the different types of ESBPs.

TYPES OF ESBPs

CONTENT | ESOPs | ESPPs | SARs |

FULL FORM | Employee Stock Option Plans | Employee Stock Purchase Plans | Stock Appreciation Rights |

MEANING | ESOPs are in form of contracts which give employees a right, but not an obligation, to purchase shares at exercise price. | ESPP is a plan under which the company offers shares to its employees at a discounted price as part of public issue or otherwise | SARs entitle the employees to receive cash or shares for an amount equivalent to the excess of market price on exercise date over a stated price. |

VESTING PERIOD | YES | NA | YES |

EXERCISE OF THE OPTION | If not exercised, then option gets lapsed. | NA | Either exercise in Equity or in Cash. |

SETTLEMENT | Equity Based | Equity Based | Equity / Cash Based |

RECOMMENDATION | -To motivate employees to perform well in coming years -To retain employees at least until vesting period -Feel of ownership amongst employees | -To Incentivize Employees for past performance -Feel of ownership amongst employees | -One-time Settlement without dilution of Equity -To retain employees at least until vesting period

|

COMPONENTS OF ESOP

GRANT

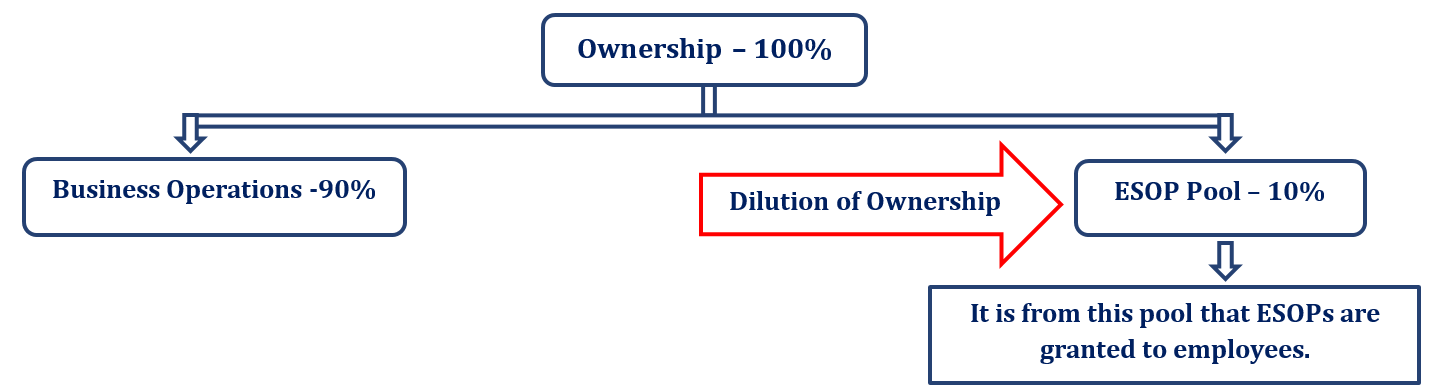

ESOP POOL:

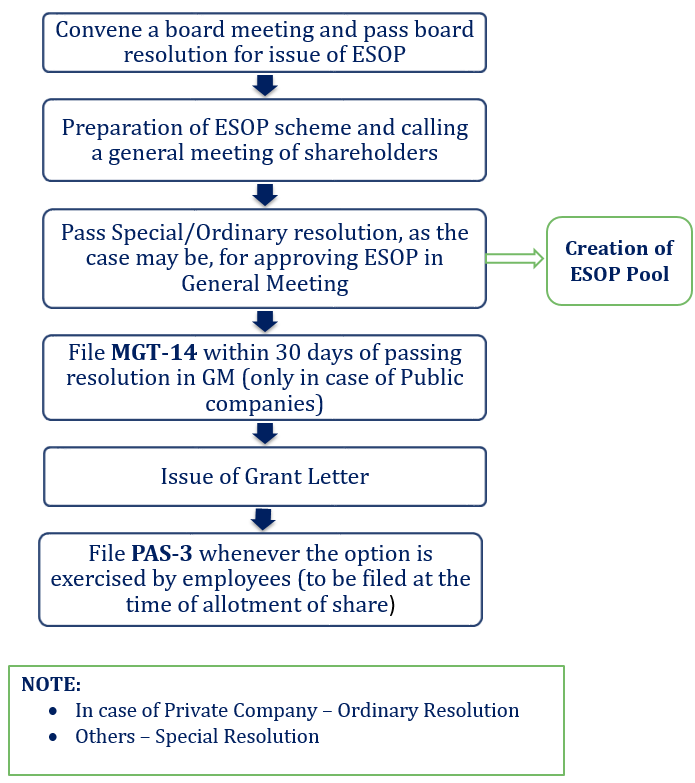

- ESOP process starts with entering into an ESOP agreement with prescribed terms and conditions and creating an ESOP Pool.

- A 10% pool is great to have in the beginning. In later stages, the pool might shrink down to 3 or 4% as the valuation of the company goes up.

PERFORMANCE FACTOR:

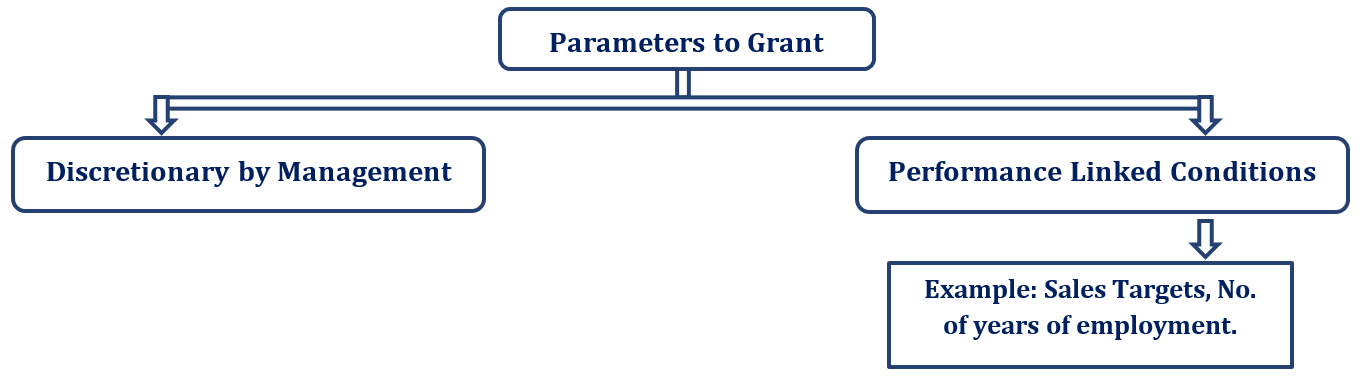

- Once the ESOP Pool is created, management shall decide parameters basis which ESOP is to be granted to employees.

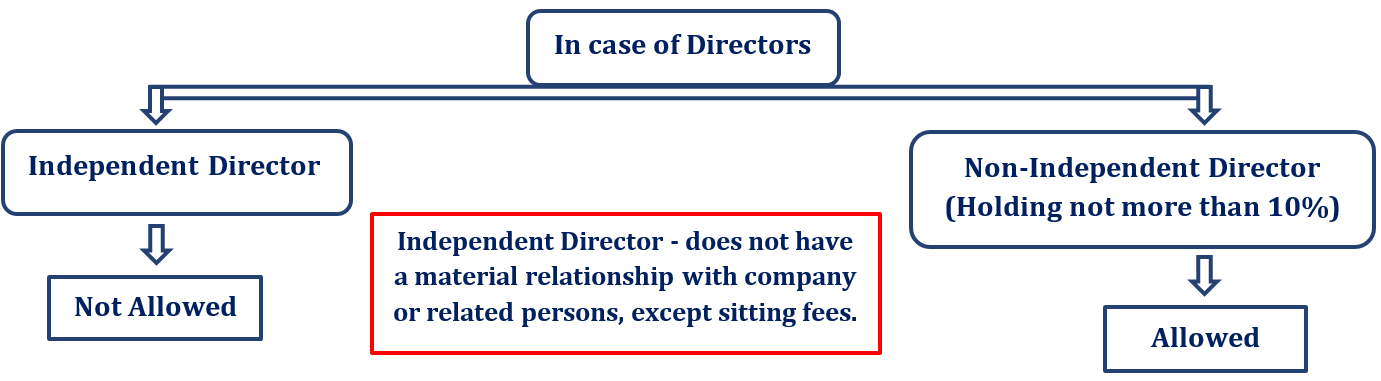

ESOP TO EMPLOYEES AND DIRECTOR:

- ESOPs can be given only to employees and Directors not having more than 10% of shareholding

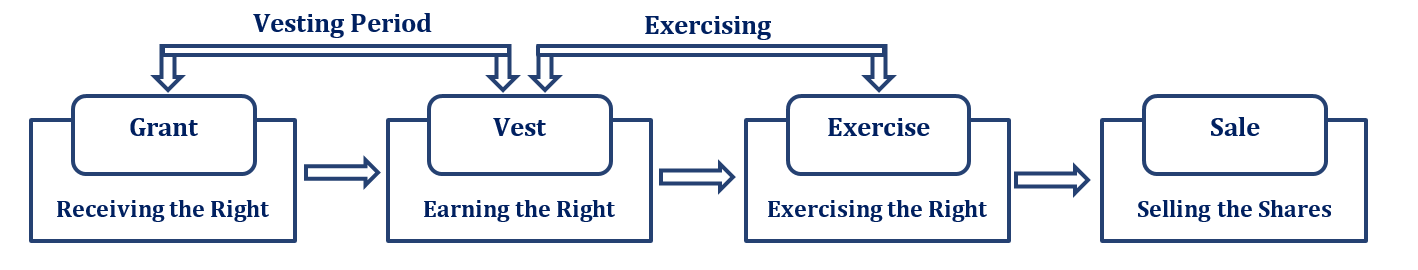

VESTING SCHEDULE

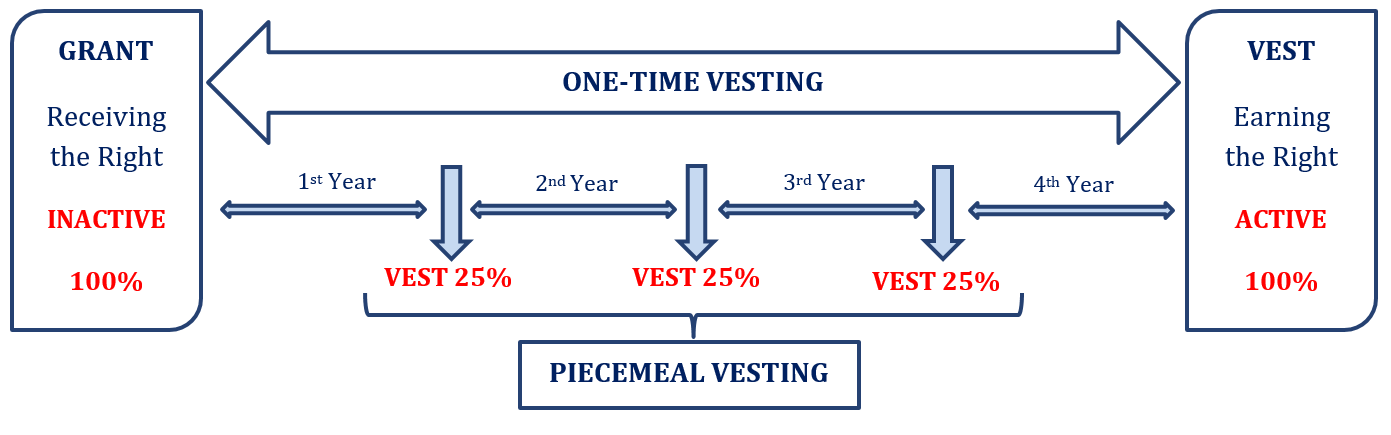

- The vesting period is the period of time BEFORE employees gets the right to acquire the shares.

- It can be either One-time Vesting or Piecemeal Vesting.

- Recommendation : Piecemeal

EXERCISING SCHEDULE

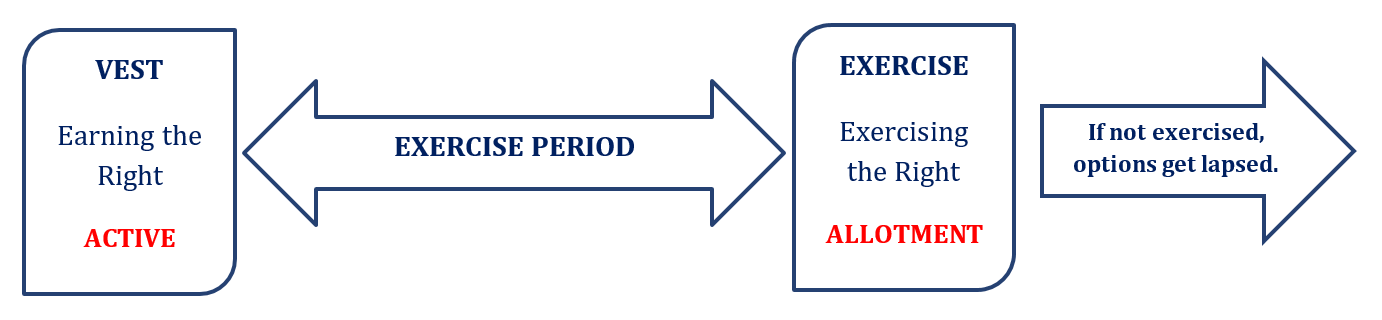

- EXERCISING PERIOD:

- It means the time period after vesting within which the employee should exercise his right to apply for shares against the option vested in him at exercise price.

- Exercise Price is the price payable by the employee at the time of exercising the options which is usually decided at the time of grant.

OTHER IMPORTANT POINTS:

LOCK-IN PERIOD: The period after allotment of share during which the employees are prevented from selling the shares. SHARE TRANSFER AFTER LOCK-IN: Management’s permission is required to transfer the shares after Lock-in period. BUY-BACK: The Company can initiate buy-back process so that the employees can transfer the share to company it-self rather than transferring to third party. OTHER SHAREHOLDER AGREEMENT: The agreement which was entered into with normal investors has as it is applied for the employees. |

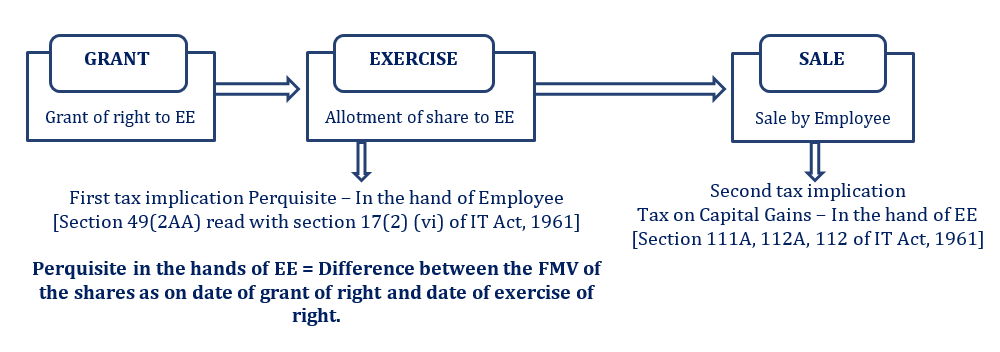

TAXATION OF ESOPs

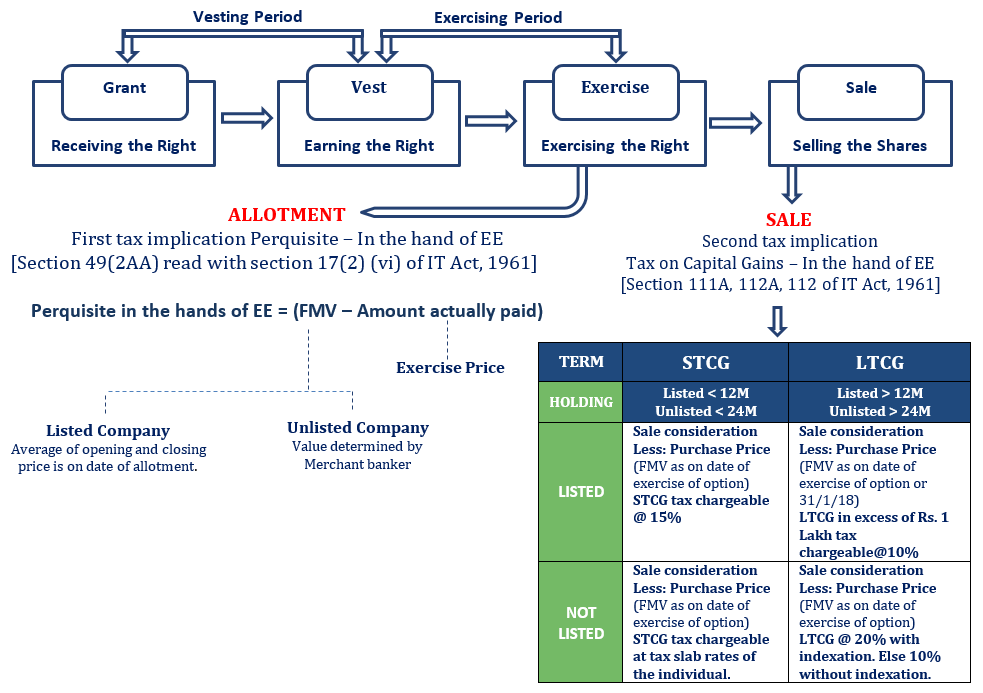

IN THE HANDS OF EMPLOYEE:

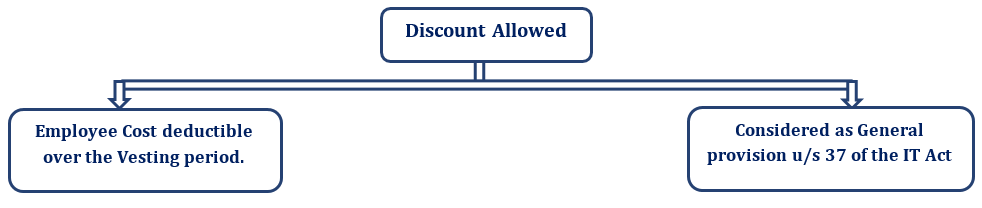

IN THE HANDS OF EMPLOYER:

OTHER IMPORTANT POINTS:

TDS: At the time of allotment of shares the ESOPs are implicated as perquisites in the hands of employees, hence accounted as salary and accordingly TDS has to be deducted u/s 192B. RECENT AMENDMENT: ESOPs given by start-ups to employees are currently taxed as perquisites in the year of allotment; Finance Act, 2020 states deferring of tax payment by employees to 5 years or till they leave the company or when they sell the shares whichever is earlier.

|

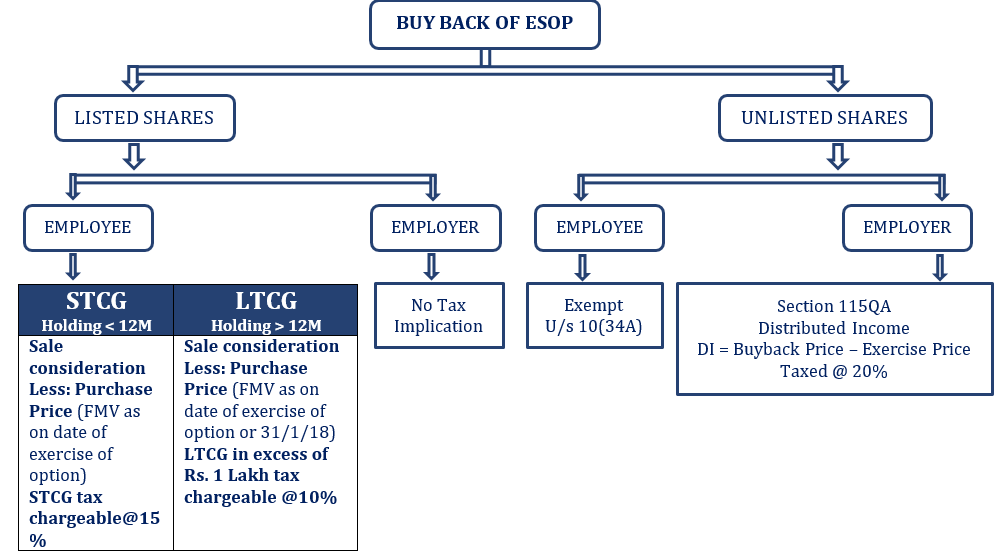

ESOPs BOUGHT BACK BY COMPANY

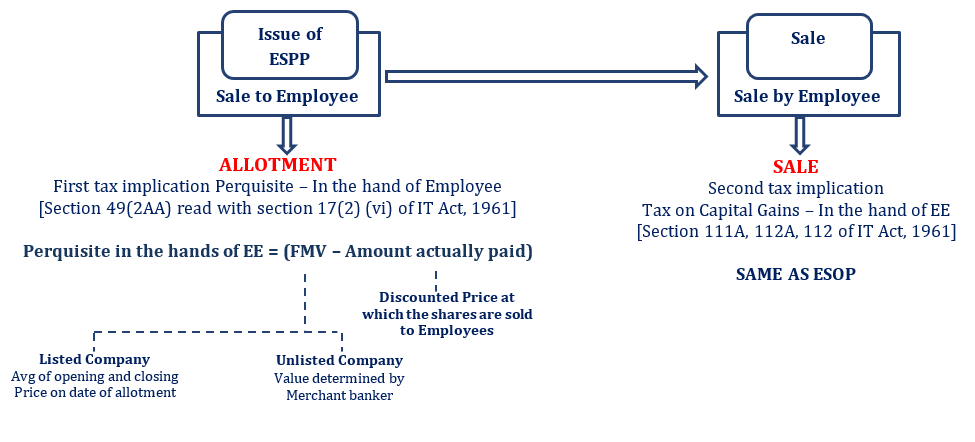

TAXATION OF ESPPs

IN THE HANDS OF EMPLOYEE:

IN THE HANDS OF EMPLOYER:

- SAME AS ESOP

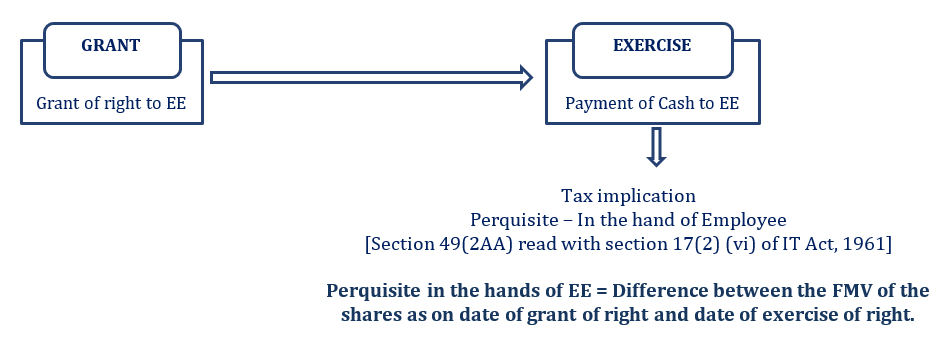

TAXATION OF SARs

EQUITY-SETTLED SARs

IN THE HANDS OF EMPLOYEE:

IN THE HANDS OF EMPLOYER:

- SAME AS ESOP

CASH-SETTLED SARs

IN THE HANDS OF EMPLOYEE:

IN THE HANDS OF EMPLOYER:

- SAME AS ESOP

PROCEDURE FOR ESOP