Companies Auditor’s Report Order 2020 brings more enhanced reporting disclosures which will provide more accurate insights to the business with completeness and accuracy providing the stakeholders knowledge about operational and financial position of the company. Such enhanced disclosures will provide foreshadow about corporate failures before the actual collapse

Onus of comprehensive disclosure lies on both the auditor and the auditee concurrently.

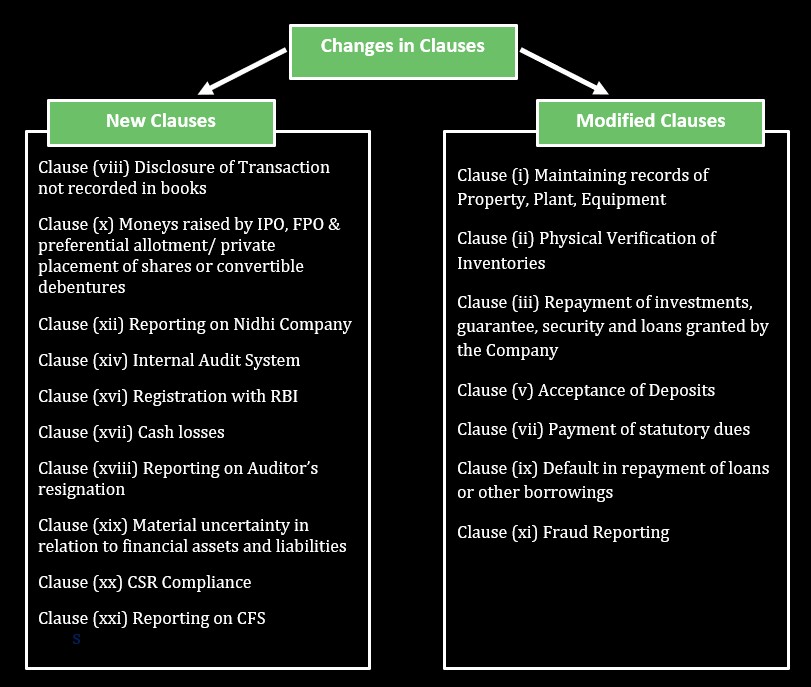

The new reporting order comes with total 21 Clauses as against the 16 clauses of CARO 2016, where 10 new clauses are added, 7 clauses of CARO 2016 are modified and 4 are retained in CARO 2020

Let us evaluate some steps which can be used to act with the new requirements.

Para 3 Clause (i) Maintaining records of Property, Plant, Equipment (PPE) and Intangible assets:

A. The disclosure requirement of ownership for all immovable property disclosed in financial statements can be met by verifying set of documents which can help to reveal real owner of property such as:

- Title Deed / Sale Deed

- Payment Receipt of Stamp Duty, Municipal Taxes or Electricity Bill

B. The auditor should look after the revaluation reserve account and report and verify whether the revaluation of assets is done by the registered valuer or not.

C. The disclosure regarding proceedings under the Prohibition of Benami Transactions Act is required. The Auditor can observe the irregularities under this act by:

- Obtaining all such notices

- Vouching outflows which are not in normal course of business and various fines or legal fees incurred by the company for proceedings

- Taking care of limits allowed to hold such properties

Clause (ii) Physical Verification of Inventories:

A. The coverage and procedure of physical verification conducted by the management can be observed by evaluating:

- Duly authenticated physical verification sheet

- Duly authenticated summary sheets/ consolidation sheet

- Internal memo, etc., regarding issues arising on physical verification

- Any other document evidencing physical verification

Discrepancies of 10% or more in aggregate for each class of inventory is now required to be reported

B. To verify whether the quarterly returns or statements filed by the company with banks and financial institutions are in consonance with the books of accounts of company; wherein the sanctioned working capital is in excess of 5 crores, in aggregate on basis of security of current assets, the auditor should conduct check on:

- Working papers of quarterly physical verification conducted

- Valuation reported under the statements is in compliance with accounting standards

- Ageing analysis of debtors and creditors

Management also has the added responsibility to maintain all such information in a proper manner for a robust disclosure.

Clause (iii) Repayment of investments, guarantee, security and loans granted by the Company:

A. New modifications require revelations for investments, guarantee, security, loans or advances provided, or to be provided to any parties are covered as against the earlier requirement of related parties, proper scrutiny of all financial cashflows, agreements regarding various commitments, contingent assets and liabilities need to take care for proper compliance.

B. Disclosure relating to Evergreening of loans or rolling over the loans is now required; specific attention should be put in place if financial health of company is weak or is turning a NPA for lenders then such facilities are used to save the company’s default. Concurrent closure and fresh loan from same institution or same group of institutions with similar balances can trigger the alarm for this disclosure. Closure of earlier loan will just change it hands without actually being settled. Such disclosure will help users to understand the financial position of company.

Disclosure about loan repayable on demand without any terms or period of payment to the promoters and related parties is mandated. Proper record-keeping by company for scrutiny of related party transactions is required.

Clause (v) Acceptance of Deposits:

Scope of reporting has been further extended by including the term “deemed deposits”. To evaluate whether the amount received is deemed deposit or not the auditor should check

- Ageing analysis of advances received for performance of an obligation (if more than 365 days in case of debtors, 5 Years in case of AMC, then it is deemed deposit)

- If amount received is not in-line with the normal course of business

Clause (viii) Disclosure of Transaction not recorded in books:

The emphasis under new clause is limited to examination of those transactions, which were hitherto unrecorded in the books of account and which were surrendered or disclosed as income i.e., by way of money, jewellery or any article in the tax assessments under the Income Tax Act, 1961. The emphasis is on the words surrendered or disclosed which implies that the company must have voluntarily admitted to the addition of such income.

The auditor is required to review all the tax assessments completed during the year and before audit completion, obtain and verify the statements made in course of search and survey, representation from management that all such assessments are made known to the auditor. Scrutiny of prior period items disclosed as per AS-5 and IND AS 8 to identify disclosed or surrendered income.

Clause (ix) Default in repayment of loans or other borrowings:

CARO 2020 has extended the scope of reporting under this clause

A. For default in loans or borrowings to any lender whether principal or interest. Auditor can evaluate the same by obtaining

- All credit agreements and understand the terms of repayments to evaluate whether company is in line with stated terms or have defaulted on same.

- By obtaining the Cibil score of the entity.

Management should ensure a proper schedule for repayment is created and followed for all compliances.

B. Reporting is required if Company is declared as a wilful defaulter by banks or financial institutions i.e.

– If company has the capacity to repay but defaults in repayment whether intentionally avoiding the payment or application of amount for other than stated purposes leading to breach of agreements.

– Siphoning off of borrowed funds or similar activities.

Auditor has to take note of

- Financial health of the company,

- It’s ability to raise and pay off the credits

- Credibility of owners of the company

- Utilisation of loan obtained by the company is for stated purposes only by checking the utilization schedule

- Whether short term basis funds were used as long-term basis funds

- Funds taken to fulfil obligation of its related entities or borrowed on security of related entity’s assets, repayment schedules

- Fund flow statements

Such modification in clause provides for robust disclosure regarding solvency and liquidity of company, end use and diversion of funds.

Clause (x) Moneys raised by IPO, FPO & preferential allotment/ private placement of shares or convertible debentures:

An addition made here is that now compliance of Section 62 (Fresh issue of shares) of the Act is also required i.e., relating to Rights issue, Employee Stock Options (ESOP) and Preferential Allotment of shares

In case of rights issue the auditor should verify through notices and statements that –

- Issue of shares is proportionately to existing shareholder only

- Notice is dispatched 3 days before issue and issue is open for min.15 to 30 days.

- If shares are not subscribed then those are disposed-off by the Board

In case of ESOP by

- Obtaining the copy of Special Resolution passed for such issue

- Whether the issue is in compliance with the ESOP policy of the company

- Where the inclusion and exclusion of eligible people for ESOP as per Companies Act is considered

- Vesting period and other terms specified are been complied

In case of Preferential Allotment by

- Following the guidelines issued by SEBI for Listed Company

- In other cases, by verifying the authentication of issue with AOA, whether special resolution has been passed, valuation report is available to verify the price, allotment is done within 12 months from resolution.

Clause (xi) Fraud Reporting:

Reporting requirement related to fraud has been changed to fraud by the company or any fraud on the company i.e., to include all types of fraud not only of its employees and officers. Auditor will have to apply various approaches like

- JV testing for data analysis

- Identify reasons why cashflows are not in-line with income

- Weak internal controls

- Irregular purchases from suspicious and related parties

- Fluctuations in promoters holding

- Internal auditor’s report

- Any instance of fraud noticed by the management. Thus, the test of risk is responsibility of both auditor and auditee.

Auditor now has to report on whistle blower complaints received during the year. Auditor has to identify if the entity has setup any whistle blowing or similar department to receive and resolve complaints, list of all such instances needs to obtained, the effects and concerns of such complaints needs to examined as they will help to go over a fine-tooth comb over governance and fraud issues in the company.

Clause (xiv) Internal Audit System:

Auditor is required to report if internal audit is applicable to the company and whether it is properly conducted and whether all the comments received from such auditors are being taken care off by the management. Whether Statutory Auditor considers the report of internal auditors i.e., all internal audit observations having a financial impact are considered and also taken care for reporting of Internal Financial controls under the Audit report

Clause (xvi) Registration with Reserve Bank of India

The auditor is required to report if the company has conducted any Non-Banking Financial or Housing Finance activities without a valid Certificate of Registration (CoR) from the Reserve Bank of India.

- The auditor shall obtain sufficient knowledge of the company’s business and nature of its revenues and assets to ascertain whether the company is conducting any non-banking financial activities by applying 50-50 test.

- Auditor should verify that loans provided by the company are not with principal objective of providing finance for housing directly or indirectly.

Audit is required to report if the company is a Core Investment Company (CIC) by examining the last audited balance sheet of the company to ascertain whether the company holds not less than 90% of its net assets in form of investment in equity shares, preference shares, bonds, debentures, debt or loan in group companies. In case of exempted or unregistered CIC whether it continues to fulfil such criteria. If the Group has more than one CIC as part of the Group, disclose the number of CICs which are part of the Group.

Clause (xvii) Cash losses:

Auditor is required to report under this clause, cash losses if any, during the financial year and one immediately preceding it, with specific amount. Cash loss is indicative of negative cash flow (i.e., when cash outflow exceeds cash inflow) Profit/loss shown in the profit and loss account to be adjusted for the effects of transactions of non-cash nature such as depreciation, amortisation, deferred tax expenses, foreign exchange gain/ loss, fair value changes etc. and it is to be adjusted with the effect of various qualifications in the respective audit periods.

Clause (xviii) Reporting on Auditor’s resignation:

A new clause has been added wherein reporting is required if there was a resignation of statutory auditors during the year. The incoming auditor has to examine the issues, objections or concerns stated in report of outgoing auditor and its effect on financials of company and whether management has taken any steps on such comments made by the auditor.

In case of listed companies, incoming auditor should also obtain copy of Annexure A which is submitted to SEBI, minutes of Board Meeting, audit committee presentation and exercise his professional judgement while evaluating the reason for resignation from the listed company.

By bringing this clause reporting requirements for resignation which is normally done as per Standards on Auditing (SA) 210 is brought into this report.

Clause (xix) Material uncertainty in relation to financial assets and liabilities:

This new clause requires auditor to report if it is of the opinion that there exists no material uncertainty as on the date of the audit report. The auditor may on basis of financial ratios, ageing of assets, defaults in repayments, decline in credit worthiness, future commitments, erosion of net-worth, increase of claims on assets of company by lenders, contingent liabilities etc. Management will also have to make a detail assessment of its future cashflows, its ability to run the company in foreseeable future based on which an opinion can be formed and the auditor should obtain management representation letter for the same.

Auditor has to perform the test of existence of material uncertainty on the date of the audit report. Thus, transactions post balance sheet date should also have to be taken care of for this clause reporting. Audit procedures should be developed in such a way that it keeps an eagle eye on the entity’s financial health.

Clause (xx) CSR Compliance:

The auditor should examine the supporting documents such as expenditure receipts, bank statements etc. for other than ongoing projects and evaluate the unspent amount if any on the basis of the CSR planning. Unspent amount and provisions for CSR if any should be transferred to a fund specified in Schedule VII within a period of six months of the expiry of the financial year.

In respect of unspent amount for ongoing projects, the auditor shall verify the bank account to ensure whether it is earmarked for CSR activity, opened for that respective financial year only and called as Unspent CSR Account. Balance if any should be spent within 3 years from the date of transfer, failing which it will be transferred to above mentioned fund.

By insertion of this clause the compliance requirements for CSR expenditure had been refined.

Clause (xxi) Reporting on Consolidated Financial Statement:

An important addition has been made where in CARO 2020 will also be applicable to Consolidated Financial Statements (CFS) of companies. Principal Auditor of a company should obtain individual CARO reports of the company included in the CFS and examine their qualifications or adverse remarks in the reports and mention the same along with the paragraph numbers in their CARO report.

Principal Auditor should mention the unavailability of CARO report of unlisted subsidiaries and associate at time of preparation of CARO report of listed company due to time gap in submission of reports.

Thus, principal auditor has an added responsibility to examine all audit reports of companies included in the consolidated statements.

Conclusion:

CARO 2020 vocalises a thorough disclosure mechanism which paves way to enhance the overall quality of the audit and reporting, putting onus on the auditee also to share all information with the auditors and users of financial statements, the benefit of it will surely outweigh the additional duties.

Authors:

Aakash Mehta

Partner | Email: aakash.mehta@masd.co.in

Ashish Raithatha

Associate Consultant | Email: ashish.raithatha@masd.co.in

Manav Bokadia

Associate Consultant | Email: manav.bokadia@masd.co.in