CONCEPT OF MSME

What’s MSME?

MSME Act became operational on October 02, 2006. It was enacted to promote, facilitate and develop the competitiveness of the micro, small and medium enterprises, rightly termed as “the engine of Economic Growth”. They are often recognised as pillars of economic growth in developing countries just like India. With adversities being faced in terms of infrastructure, market linkage and competition from domestics as well as international markets, the sector has stood tall and also been instrumental in the growth of country’s GDP.

What’s Udyog Aadhaar?

It is an identification system, similar to Aadhaar, but specifically for businesses. Earlier Udyog Aadhaar Registration was an online method by which an MSME can get a 12-digit Udyog Aadhaar Number and then go for MSME registration. Therefore, one can say that both are different, but now Udyog Aadhaar registration is the new way of MSME registration.

- DEFINITION OF MSME

As per MSMED Act, 2006 the Micro, Small and Medium Enterprises (MSME) are classified in two classes viz. manufacture & service sectors.

Under the Aatmanirbhar Bharat Abhiyan (ABA), government revised MSME definition where they replaced the criteria of investment in plant & machinery to investments & turnover, where both are to be considered for deciding MSME. Further exports will not be counted in turnover. Also under the revised definition the distinction between manufacturing and service sectors has been removed.

Composite Criteria- Investment and Annual Turnover

Classification | Micro | Small | Medium |

Manufacturing & Service Sector

|

Investments < 1 crore & Turnover < 5 crores

|

Investments < 10 crores & Turnover < 50 crores

|

Investments < 50 crore & Turnover < 250 crores

|

Points to be noted:

- To do the registration the small and medium scale industry owner can file form in both manners i.e. whether online or offline.

- Secondly, there is no registration fees required to be paid for this process.

- The provision of excluding the exports with respect to turnover will encourage the MSMEs to export more and more without fearing to lose the benefits of a MSME unit.

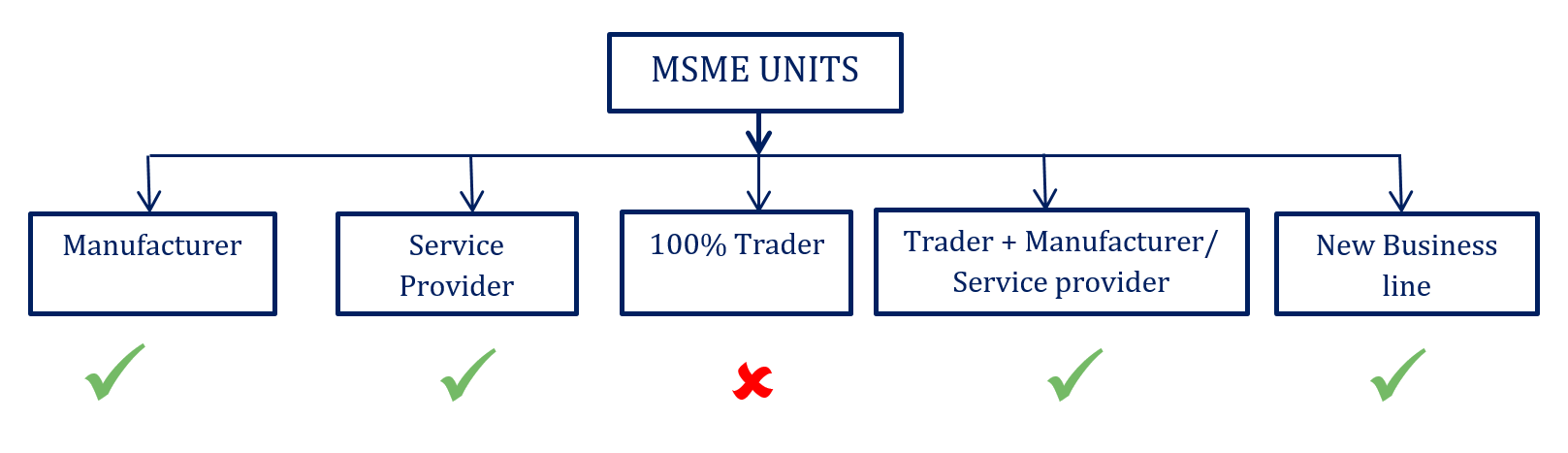

Who can avail the benefits under MSME registration?

It’s true! Under MSME definition, traders are not covered. But there are two exceptions:

- A trader who manufactures his product which is unique in some way and then trades, he can get himself register under MSME.

- A trader, who also provides services of the product he sells, can get register under MSME as service provider.

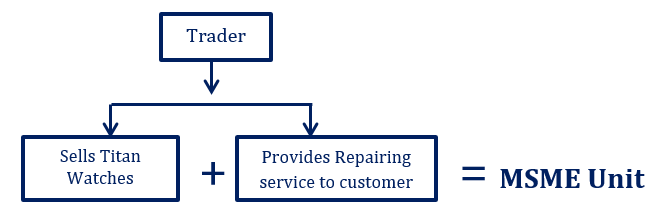

Example

Activities (NIC codes) not covered under MSMED Act, 2006 for registration of Udyog Aadhaar Memorandum.

Ministry of Micro, Small, and Medium Enterprises (MSME) has clarified via notifications that the following activities would be specifically not included in the manufacturing or production of commodities or rendering of services as per Section 7 of the said Act.

- NIC code – 02 Forest and Logging

- NIC code – 03 Fishing and aquaculture

- NIC code – 45 Wholesale, retail trade as well as repair of motor vehicle and motorcycles

- NIC code – 46 Wholesale trades except for motor vehicles as well as motorcycles.

- NIC code – 47 Retail Trade Except for Motor Vehicles as well as motorcycles

- NIC code – 97 Activities of households as employees for domestic personnel

- NIC code – 98 Undifferentiated goods/services-producing activities of private households

Ref: https://udyogAadhaar.gov.in/Web/doc/Activities_NIC_CodesNotAllowed.PDF

Registration Process & Documents required

For getting registered as MSME under the Act, following steps should to be followed.

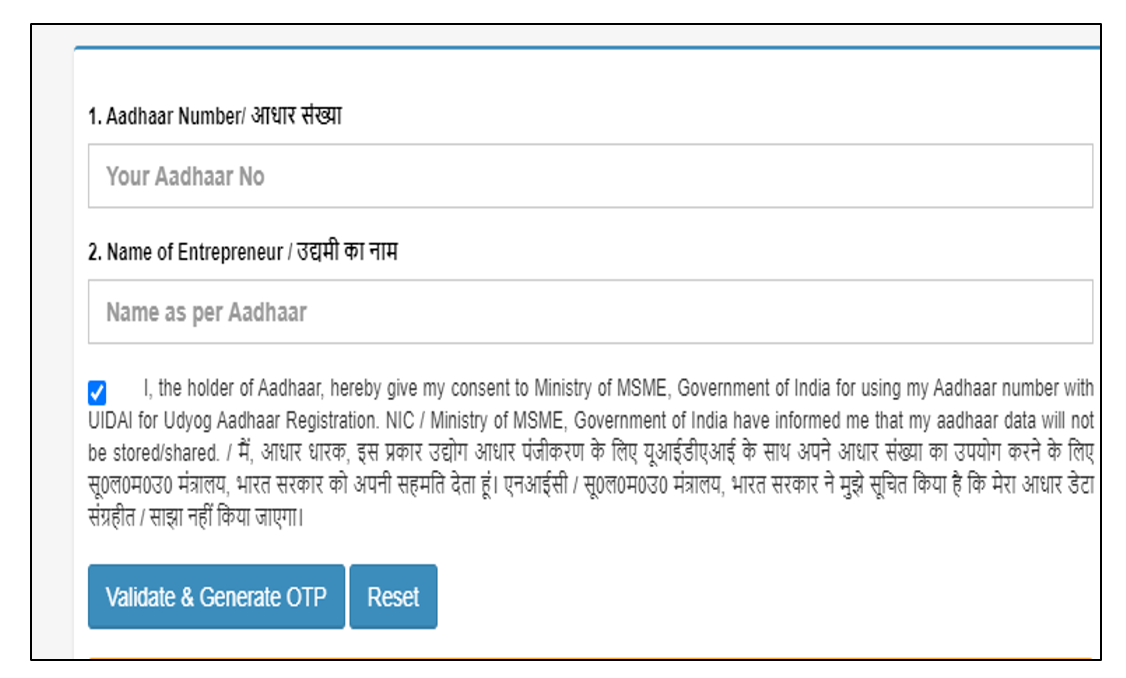

Login to Udhyog Aadhaar Official Website

(Link: https://udyogAadhaar.gov.in/UA/UAM_Registration.aspx)

Enter Aadhaar No. & Name of the entrepreneur

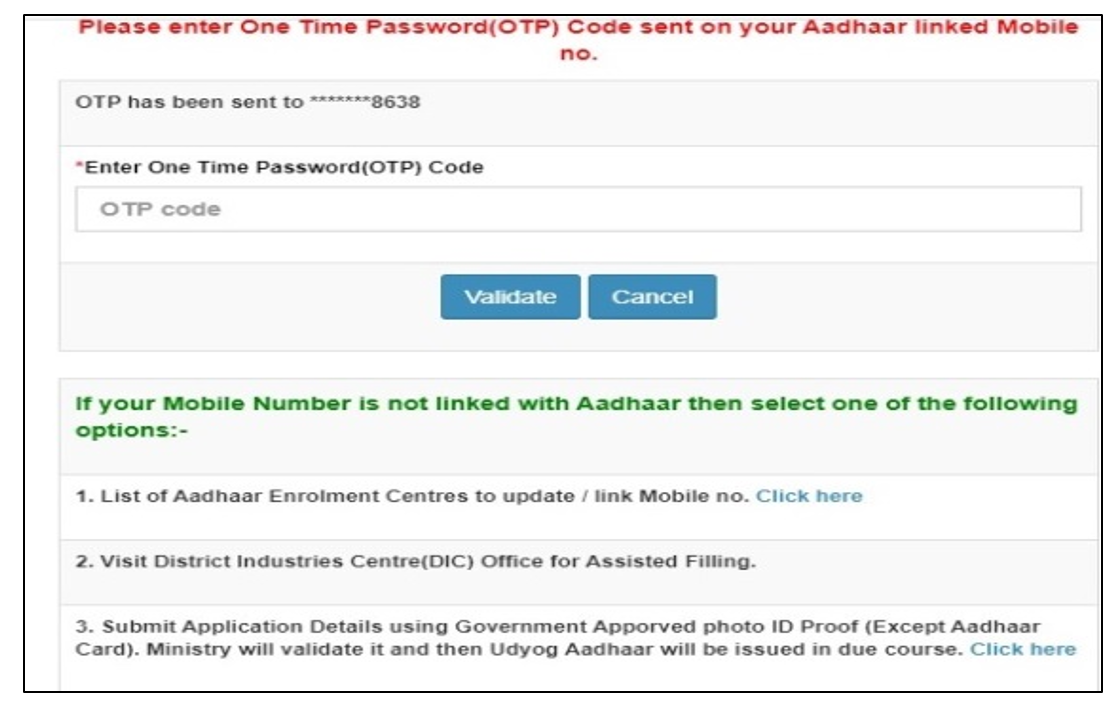

OTP will be sent to the mobile number linked with Aadhaar

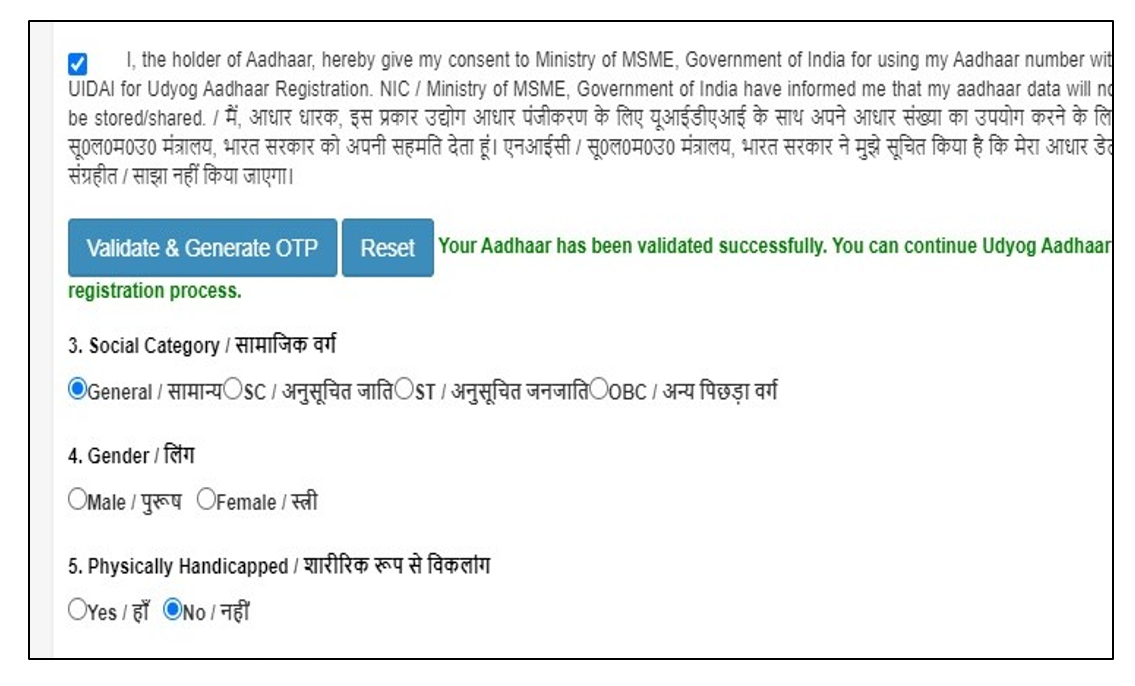

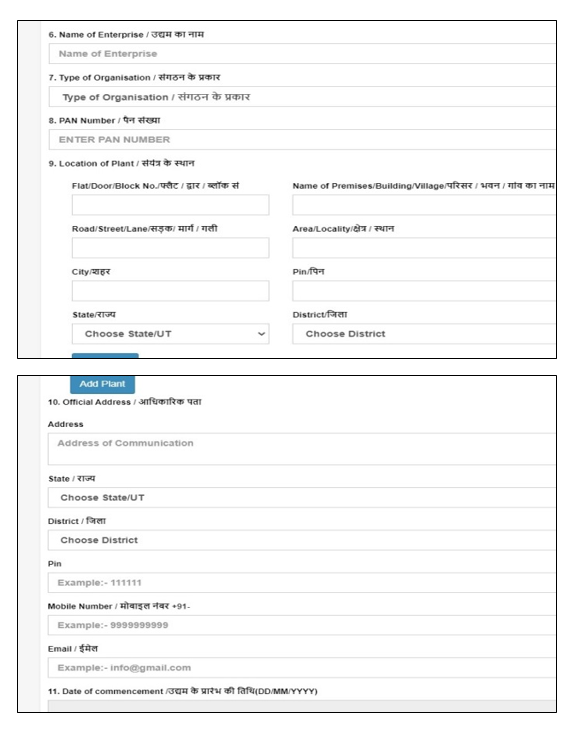

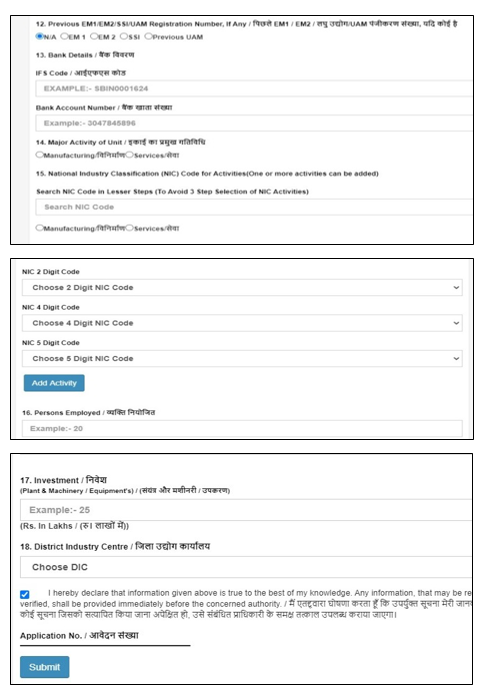

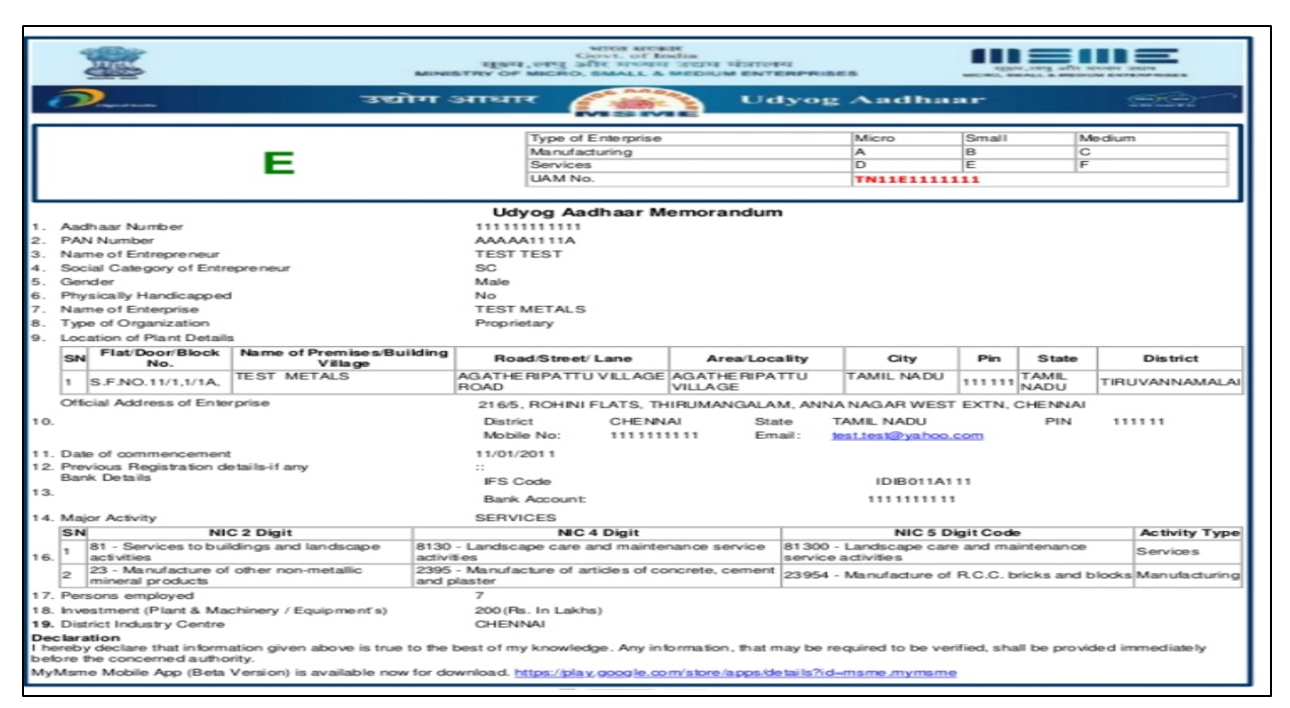

Once validated, an application form will appear. Personal as well as basic information needs to be filled in the form. The form looks like this:

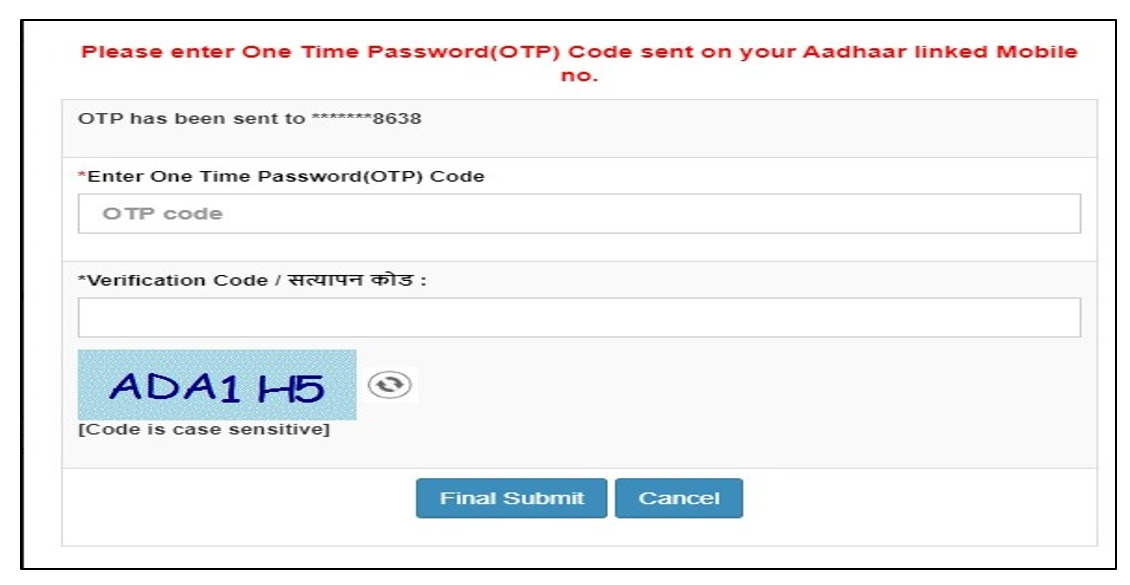

After clicking on submit, an OTP will be sent on the Aadhaar linked Mobile Number. For Final Submit enter the OTP and verification code. Once submitted an Udyog Aadhaar Memorandum number (‘UAM’) will be generated.

Option for registration without Aadhaar:

An applicant or the authorised signatory who is not yet enrolled for Aadhaar shall have to apply for Aadhaar. Enrolment ID slip, provided till the time Aadhaar is assigned to the individual, shall be used for granting UAM number and the same shall done by the concerned DIC or MSME-DI on behalf of such enterprise, subject to the production of the following documents as alternative and viable means of identification.

- If enrolled for Aadhaar, his Aadhaar Enrolment ID slip or a copy of request made for Aadhaar enrolment;

- Any of the following documents, namely: – Bank photo passbook; or voter ID card; or passport; or driving license; or PAN card; or employee photo identity card issued by the Government.

Documents required during the process of registration:

þ Aadhaar cards of Proprietor / Partners/ Directors

þ Copy of PAN Card business

þ Name of business as well as the address proof of business

þ Investment & Turnover details

þ Proof of date of commencement of business

þ Partnership deed or MOA/AOA

þ Sales as well as purchase bill copies & copy of bank statement

þ Valid mobile no. as per Aadhaar card & registered email address

MSME Certificate

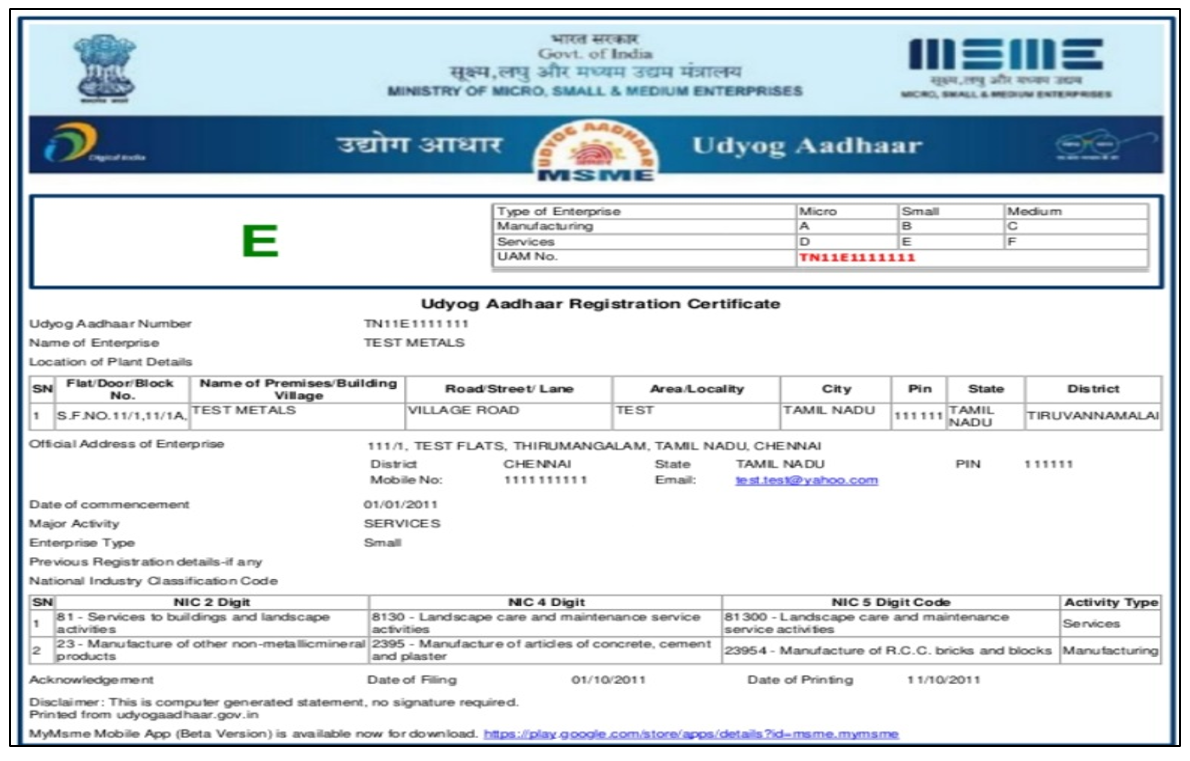

Memorandum certificate is received when an entity submits the application form and receives UAM number.

Registration certificate is received after submitting the documents as per the requirement.

Disclaimer: The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Authors:

Vishal Kothari

Partner, MASD

E-mail ID: vishal.kothari@masd.co.in

Riddhi Thakkar

Consultant, MASD

E-mail ID: riddhi.thakkar@masd.co.in