Introduction

In the past couple of years, the Indian accounting landscape has seen a spurt in the number of ERP software available to entities to choose from. To name a few – QuickBooks, Zoho Books, MargERP, Vyapar, Accounts ERP, etc. However, Tally still has a major market share in the number of users. It is considered as a one stop solution for all the accounting, compliance, and reporting needs of a small / medium enterprise. However, why is Tally still prevalent amongst the community even though there are far better software in the market that give users the access to CRM, client servicing tools, better reporting mechanisms, improvised user interface and what not. The answer lies in the sheer ability of Tally to satisfy each and every aspect of the financial needs of an entity. Despite being around for ages, even today there are tons of new features that Tally adds to its arsenal regularly. In this article, we have handpicked few of these features which are either not known or are undermined in the small / medium enterprise domain.

Tally Definition Language (commonly known as TDL)

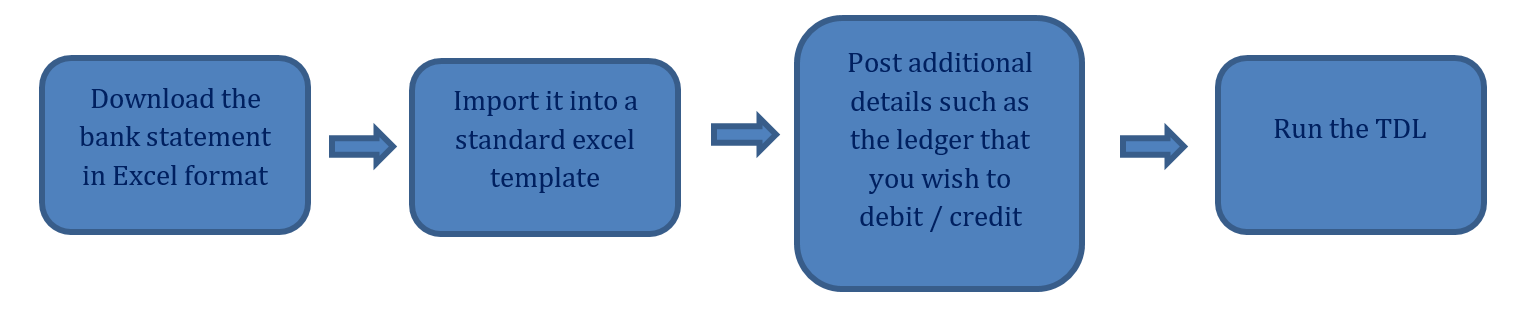

Simply put, TDL is a language, using which a person can talk with Tally. It can help an organization in significantly reducing the time taken to post entries related to sales, purchase, receipt and payment. Let’s say you want to post 200 entries of your bank statement of a particular month into Tally. All you have to do is:

As soon as you run the TDL in Tally, the software automatically posts all the entries in the bank account by creating 200 vouchers and also it will create all ledgers which are not present in tally automatically. Just imagine the time it would take for an accountant to manually post each and every entry from the bank statement in Tally. Not to mention any posting error that might occur while he is at it, the tedious task of reconciling the bank balance. All of this gets eliminated once you use TDL. In the same manner, we can post thousands of sale / purchase invoices in a matter of seconds. This can be really helpful in retail / manufacturing entities having hundreds of sale / purchase invoice on a daily basis. Instead of the accountant sitting all day long and posting entries, a single TDL can be run at every day end before close of business. CA firms who are providing book keeping services to their clients can benefit enormously from this as automation.

Inventory

Inventory usually is the biggest chunk of current assets of any entity. Step into a manufacturing organization, and you will find that there is either no / inaccurate inventory reporting in ERP in 9 out of 10 entities. This is primarily because manufacturers are more concerned with production activities and give little attention to inventory accounting. However, with more and more second generation individuals stepping into their family businesses, they want real time information at the click of buttons. It is time that organizations truly utilise the inventory accounting features that Tally has to offer. Some of the unique features are:

a. Re-Order Levels: Ask the production manager of an entity what is the minimum quantity of raw material ‘x’ that you need at all times to fulfil your sales order. He would be able to answer. But ask him what is current usable quantity of the raw material ‘x’, after which you will have to place an order to keep your sales order afloat. He might not be able to give an answer. It is not possible for a human mind to keep track of real time stock of hundreds of raw material. Why not take the help of Tally and define the re-order levels for each raw material? ROL will help the Purchase department in knowing when to place an order for raw material. It will help the Sales Department to commit on delivery dates to their clients based on raw material availability. It will ensure that the company is not sitting on huge piles of inventory, especially during this period of COVID-19 where business operations have hit rock bottom. The benefits spread across functions.

b. Price level & Price lists

An entity might sell a product to its authorized dealer, its distributor, to a retail customer all at the same time. However, the price charged to each of them will definitely vary according to the agreed terms. Using the Price Level functionality in Tally, one can define multiple price levels for Wholesaler, Distributor, Retailer, etc. This proves to be of great help to entities who have multiple contracts with multiple clients for a single product. Further, while making sales, organizations have a direct relationship with the quantity sold and discount offered. Higher the quantity of sale, higher would be the discount. Imagine calculating the discount every time you make a sale. Tally helps you to create a price list which has the quantitative brackets and the discount offered for that bracket. Once you enter a particular quantity, the software automatically calculates the discount. All you have to do is enable a few features in Tally and prepare the relevant masters as a one-time activity.

c. Bill of Material (BoM):

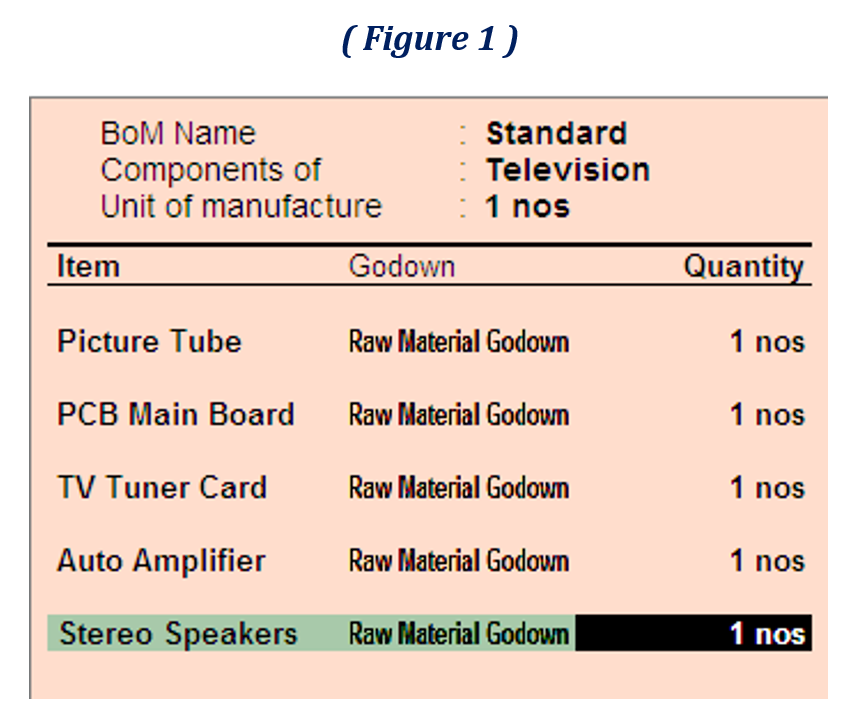

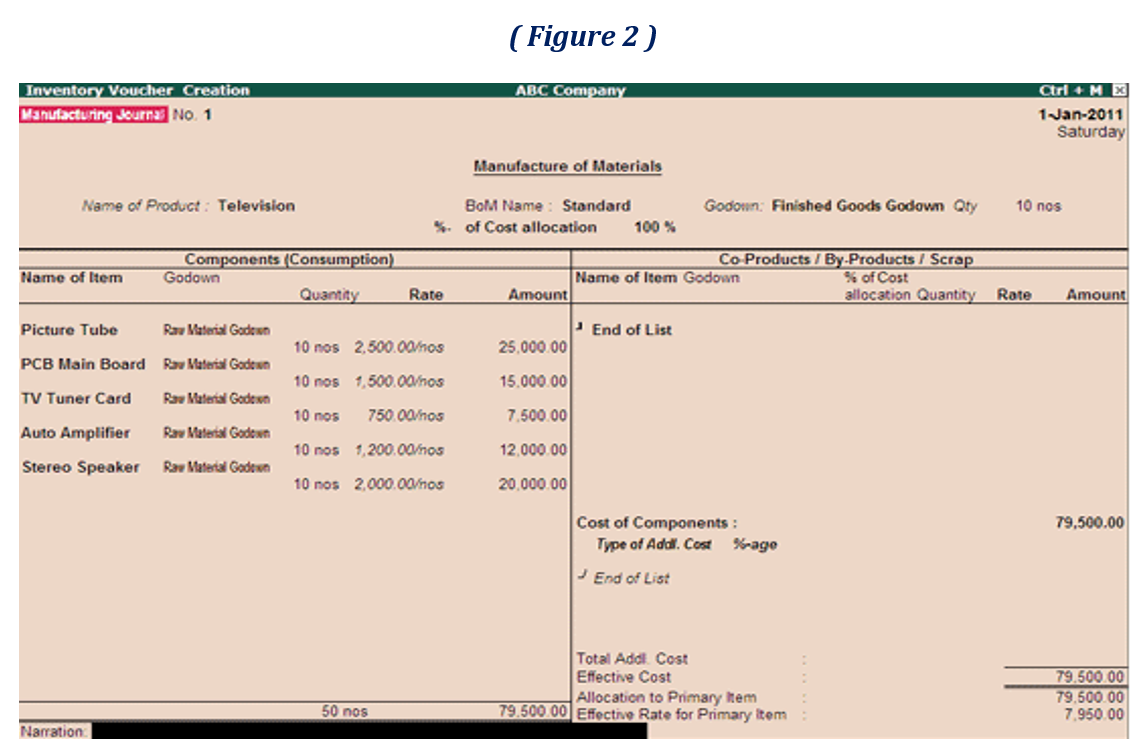

Vast number of manufacturing organizations does not use the functionality of Bill of materials available in Tally. This results in no accounting trail of production entries. In order to incorporate the production module In Tally, all that an organization needs to do is to enable BoM. As a one-time activity, details have to be fed in the inventory masters of the raw material, packing material, etc. which is consumed in the production of a finished good stock item. Once the master is created, at the time of passing production entry, all you have to do is mention the quantity of finished goods manufactured. The software automatically reduces the stock of raw material and converts it into Finished Goods. However, it might be possible that a product is supplied to another customer by making only some minor additions / deletions to the pre-existing BoM. In this case, Tally also allows you to maintain multiple BoM for a single finished good stock item.

Steps for implementing BoM:

Gateway of Tally >> F12 Configuration >> Accounts / Inventory Info

Select “Enable component list details (Bill of Materials) to YES

All manufacturing transactions can be routed either through the stock journal / manufacturing journal. Once this is enabled, while creating / altering a stock item, you define the BoM. A screenshot of the BoM for manufacturing a television can be seen below:

Barcode

Many do not know that it is possible to generate a barcode from Tally by making minor customisations to the software. Entities which are into the FMCG sector or sell huge varieties of products often complain that Tally takes up a chunk of their time if they implement the complete manufacturing cycle in it. However, this is not true. One can pass production entries basis the Figure 1 (above) and Figure 2 (above). As soon as the entry mentioned in Figure 2 is passed, the software can generate unique bar codes label that can be pasted on the outer boxing of a product. All this will happen from Tally itself. It might seem to be a time consuming process, however on the contrary, barcodes get printed instantaneously. Speaking of dispatching goods to clients, let’s say you want to load a consignment of 500 boxes (on which bar codes have already been pasted) into a goods carriage. All you need to do is place the boxes on the conveyor belts. As soon as the box passes from the Bar code scanner, it will identify the product and Tally will automatically create an outward entry / delivery challan / invoice for those stock items. The benefit being, everyone gets a real time update of the stock availability of Finished Goods, production entries are posted automatically, dispatch entries are posted automatically.

Payroll

Tally Payroll is integrated with Accounting to give the user the benefits of simplified Payroll processing and accounting. Tally Payroll enables users to set up and implement salary structures, ranging from simple to complex, as per the organization’s requirements. Yes can also align and automate payroll processes and directly integrate them with main stream accounting applications. Payroll data can be viewed as part of the existing and configurable cost centre reports for business analysis. Tally Payroll also supports configurable formats for pay slip printing; flexible salary/wage, attendance, leave and overtime registers; gratuity and Expat reports.

Benefits of using Tally Payroll

- Time spent on processing salaries, manual and paper work can be cut down to a great extent.

- Accurate and timely salary processing.

- Tracking and reviewing of employee’s absence and salary calculation as per the attendance is much easier.

- Generate the Payment Advice to instruct the bank for salary payment.

- Pay slips can be printed, exported to Excel or emailed to the respective email accounts of the employees.

- All payrolls related reports can be generated with a click of a button.

Above all, the Payroll feature is completely integrated with Accounts.

TDS compliances

Tally’s TDS Feature enables you to handle all the functional, accounting and statutory requirements of your business in an accurate and simplified manner. The TDS functionality in Tally has the following features:

- Simple and user-friendly

- Quick and easy to set up and use

- Create single Expenses Ledger for Multiple Nature of Payment

- Create single TDS Duty Ledger for Multiple Nature of Payment

- Book & Deduct TDS in the same voucher

- Single TDS deduction for multiple vouchers

- Single TDS deduction for Multiple Nature of Payments

- TDS deduction on partial applicable value

- Retrospective Surcharge Deduction

- Party wise configuration for Lower / Zero rate

- Party wise configuration to Ignore IT / Surcharge exemption Limit

- Deduction of TDS on advance payments

- TDS deduction on Non-Resident (Sec.195) payments

- Reversal of TDS

- Print TDS Challan (ITNS 281)

- Print Form 16A

- Generate E-TDS Returns

- Print Form 27A

- Print Form 26, 26Q, 27, 27Q with Annexure(s)

- TDS Computation Report

- Generate TDS Outstanding and TDS Exception Reports

GST compliances

Tally’s GST Feature helps you in filing GST returns with minimal efforts. Tally provides GSTR-1, GSTR-2, GSTR-3B and e-Way Bill related reports. The GSTR-1 report in Tally is designed exactly as the form GSTR-1 to make life easy for users. To use Tally for GST compliance, you need to activate the GST feature. Once activated, GST related features are available in ledgers, stock items, and transactions, and GST returns can be generated.

To enable GST following are the steps: Press F11: Features > F3: Statutory & Taxation > Click ‘Yes’ in Enable Goods and Service Tax (GST) > Click ‘Yes’ in Set/alter GST details > This will display another screen where you can set GST details of the company such as the state in which the company is registered, registration type, GSTIN number etc.

Security

Gone are the days when sensitive information was available only with the personnel of Accounts department. Ever since the adoption of the functional type of organization, where roles are divided basis the functions, information sensitivity and confidentiality has gained tremendous importance. The last thing a business entity wants is unauthorized use of information by mischievous employees. Keeping this in mind, Tally has proactively designed exhaustive access rights that can be assigned to a person based on the role he is performing in the organization. System administrator can choose the voucher types (receipts / payments / sales / purchase, etc.) to which his / her employee can have access. Further one can also choose to set view / alter / delete controls. Administrators can use the period lock and restrict the backdated voucher entry feature for selected employees. The in-built feature helps administrators in ensuring that no one can alter the voucher entries for the period specified by the admin.

Other Features

Other features that Tally has include remote access, audit programmes and other auditing tools, implementing Tally Server, mass mailing, alternate units of measurements, Tally ODBC, cheque printing, stock query, POS operations with Shopper 9, etc. There are plenty of resources available who can operate tally with ease with all those features.

Tally Prime

Our business has grown over the years and our business software needs to keep up with the growth. Recently, Tally Solutions have announced its flagship product called Tally Prime. Tally Prime is designed keeping in mind the aspiration of the new India and is the worthy successor to one of India’s most successful accounting software. Here are some of the features of tally prime:

- Multi-task capability: Tally Prime supports multi-tasking and helps you handle the day-to-day interruptions. Using Tally Prime, you will be able to handle many situations without the hassle of switching between multiple instances of Tally or the worry of losing your progress.

- Go To feature: With Tally Prime, discovering insights just got easier. This is made possible with Tally Prime’s new and powerful search bar called “Go To”. Using Go To, you can search and find the things you didn’t know Tally could do for you and discover new insights to run your business better.

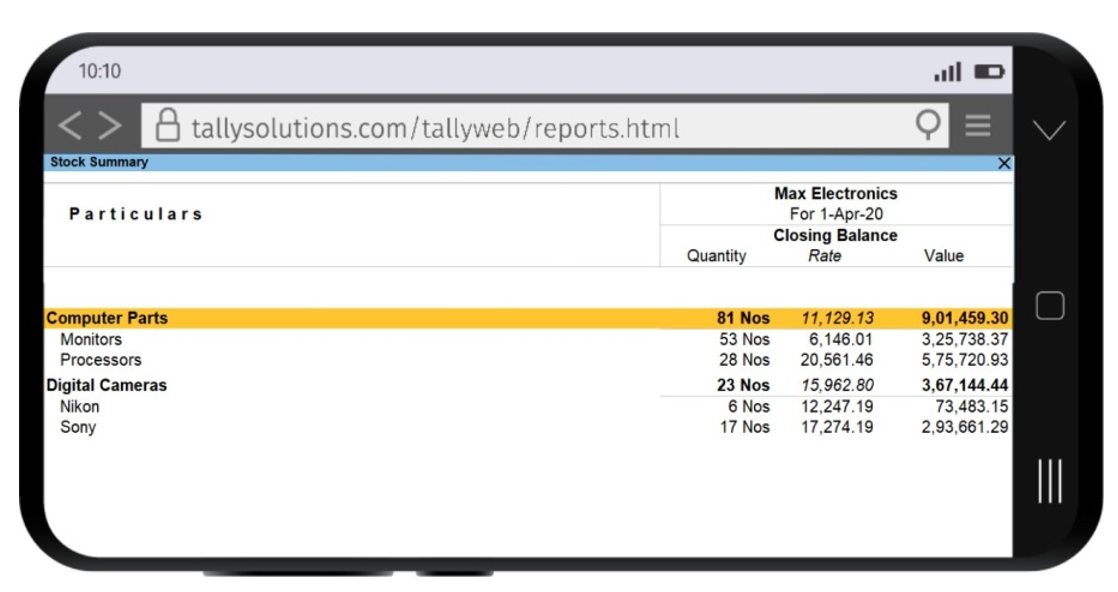

- Access Business Data Online: Tally Prime gives you the ability to view business reports online from the comfort of a web browser, wherever you are with the promise that your data will always rest with you.

Conclusion

Nowadays as each business is growing, they need a powerful ERP to handle and provide the reports which simplifies their workload. Tally is simply the best option to make your business career a fortune. Tally provides you with everything from accounting to invoicing, stock control to barcoding, and much more. Tally is a room stacked with confidential files and sensitive information which is properly secured by its security control. One can also analyse the profit of particular business and decide the further moves by using Tally’s ratio analysis feature. There are several customisations possible in Tally as required by the business which can be very helpful to simplify the work process. In all Tally software is a complete Accounting, Inventory, Taxation, and Payroll software.

Authors:

CA Aakash Mehta

Partner | E-mail ID: aakash.mehta@masd.co.in

Aakash Kothari

Senior Consultant | E-mail ID: aakash.kothari@masd.co.in

Zaran Saiya

Associate Consultant | E-mail ID: zaran.saiya@masd.co.in