Act: -

The Maharashtra Labour Welfare Fund is covered under The Maharashtra Labour Welfare Act, 1953. It is applicable in the state of Maharashtra. The mission of this welfare fund is to create social, educational, and financial advancement for laborers, by promoting welfare schemes, programs, and facilities to the eligible and registered workers of the various sections of society in the state of Maharashtra.

Applicability: -

Companies in the state of Maharashtra having more than 5 employees have to contribute to the Maharashtra Labour Welfare Fund. This includes all employees, including employees through contractors. However, this excludes those employees working in a managerial or supervisory position and receive wages more than Rs. 3,500/‐ monthly. It is pertinent to note that these funds are considered as fringe benefits.

CONTRIBUTION: -

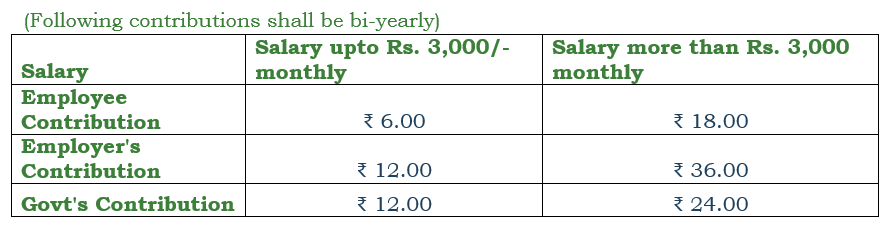

The fund is formed collectively by contributions from employees and employers. The employer contributes three times the amount contributed by the employee. The muster roll contains the employee attendance register. A Contribution is to be deducted from the salary of employees twice a year, that is in the month of June & December. Following are the rates at which the contribution shall be deducted: –

The due date for the contribution to the fund is 15th July for the period ending 30th June. The due date for the same for the period ending 31st December is 15th January.

- Moreover, the employer is required to submit a statement which states all the particulars related to the contribution made.

How is the payment for the contribution made?

- The contribution paid by the employer and employee forms the part of the labour welfare fund and is submitted to the board.

- Such contribution amount is paid twice in a year, on 15th July and 15th December, in FORM A-1

- The state government may change the rates of contribution every 3 years, on the request of the Board

- The employer can even deduct the amount of contribution from the wages of the employees and such deduction will be considered to be authorised deduction.

- The amount of contribution (both employer-employee) should be paid either in cash, money order or through cheques

- The employer submits the statement of the contribution to the Welfare Commissioner before 31st July and 31st December in FORM A-2

- The welfare commissioner further submits the statement received by him to State Government

What are the various types of Forms require under the Maharashtra Labour Welfare Fund Act, 1953?

- FORM A-1: Statement of contribution submitted by the employer to Welfare Commissioner

- FORM A-2: Statement of contribution submitted by Welfare Commissioner to State Government

- FORM A: Account of funds

- FORM B: Register of Wages

- FORM C: Consolidated Register of unclaimed wages and fines

What are the Offences and Penalties under the Act?

- Failure of employer to pay unpaid accumulations/fines on time-

Notice will be issued to the employer to pay the amount on time by Welfare Commissioner

- Failure of employer to pay the amount of contribution within the time limit:

- For 1st 3 months interest at 1.5% of the said unpaid amount

- After that, interest at 2% of the unpaid amount

- Any person who either obstructs an inspector in discharging his duties; or fails to produce records, and registers required by the inspector: such person shall be punished with imprisonment up to 3 months, or fine up to Rs.500, or both. Further in case of the commission of the same offense subsequently, punished with imprisonment up to 6 months, or fine up to Rs.1,000, or both

(This article represents the views of the authors only and does not intend to give any kind of legal opinion on any matter)

Author(s):

Agraj Kumar Singh

Senior Consultant | 8097359925 | info@masd.co.in