Introduction: –

Life Insurance Corporation of India (LIC) is a giant Indian based Statutory insurance and investment corporation with nearly 290 million policy holders as of 2019, which makes up almost two-third of the overall Insurance sector. LIC was formed by nationalising and amalgamating private insurance companies which included around 245 companies under the Insurance Act, 1956. It started issuing policies in the year 1956, and thereby creating a monopoly on India’s Insurance sector. The Headquarters of LIC are in Mumbai with 2000 branches and 1 Lakh employees. Even in the liberalized scenario of Indian insurance sector it continues to be the dominant life insurer and is moving fast on a new growth trajectory surpassing its own past records.

Reason for launching IPO of LIC: –

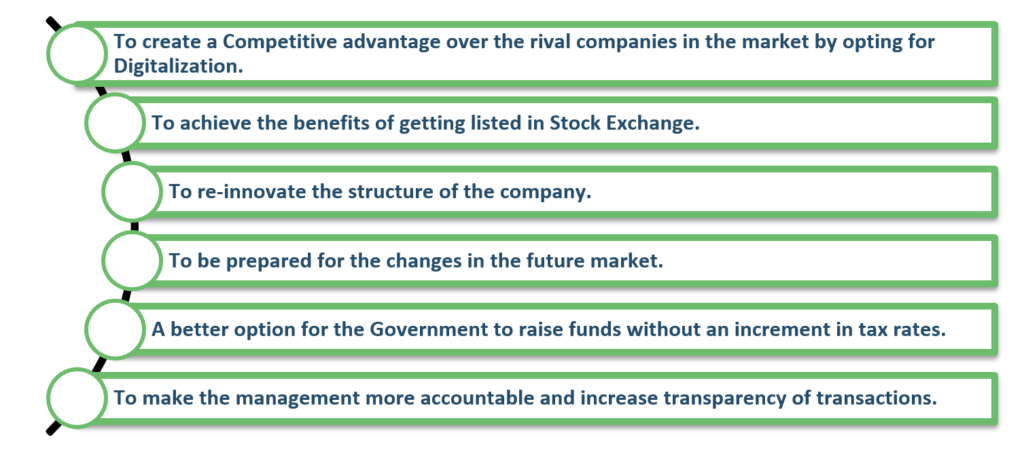

More than two decades after privatisation, LIC continues to be the leader with 66% market share as of 2021. Its sheer size makes it a systematically important company for India. As a part of proactive strategy, the Government planned to launch LIC IPO due to following reasons:

Reasons for failure of IPO: –

There are certain reasons due to which the India’s most awaited IPO had a disappointing debut in the market. Some of the possible reasons are discussed below:

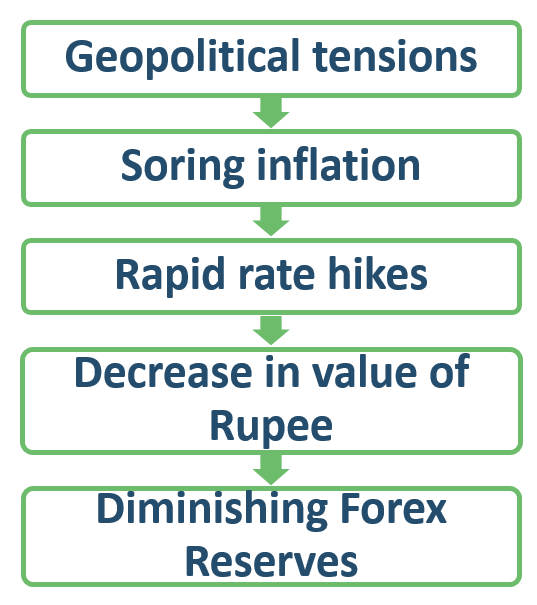

- The shares of the LIC fell prey to stock market volatility due to: –

2. Drastic cuts in plan of Government to sell it stakes which was earlier 10% to 5%.

3.The Russia-Ukraine Crisis resulted in a global tension which created a panic among the foreign investors due to which they started selling their holdings.

4. Owing to the deadline of Red Herring Prospectus, it was necessary to take appropriate steps due to which the government had to proceed with IPO even though the market conditions were critically volatile for an IPO debut.

5. The growth of LIC’s new business premiums declined significantly as a result of lockdowns which were imposed due to Covid-19.

6. The poor returns on insurances, lossy investments, lack of modernization, product diversity.

7. Major government interference in decision making process.

8. The big players of the share market silently exiting.

Impact of LIC IPO: –

LIC with hassle free processing and rich background in settling claims, has earned the trust of people. Since LIC majorly depends upon agents for selling its policies, it has created a large number of employment for people in India in the process. LIC had earned a good reputation in the Indian market over the years, which played a major role in creating anticipation among the people for the IPO. But the behemoth was unable to give listing gains to its investors, on the other hand investors of LIC lost over Rs. 50,000 crores since its debut on stock market on 17th May 2022.

However, on a positive note, the LIC IPO may help rejuvenate before any real problems come to its door. It will ensure that the Government is not its sole owner. When the people would own LIC, even though a small share, they would have their representatives on the board. The management will have to professionalize and experts would take over its decision making. The resulting transparency and efficiency will ensure high returns to its customers.

Conclusion: –

The LIC IPO failed to meet the dreams and expectation of the investors. Though it had a poor debut, it has the potential to let the investors enjoy a reasonable amount of profits over a period of time. The IPO has avoided an increase in Tax rate to some extent as the Government obtained a fair amount to balance the impact of Covid-19 on the National economy. The market is still bullish on LIC owing to its strong fundamentals, stability, operating metrics, and expected recovery in the market.

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors:

Kushal Mehta

Associate Consultant | +919930612247 | kushal.mehta@masd.co.in |LinkedIn profile

Shripriya Aithal

Associate Consultant |+918779984264|shripriya.aithal@masd.co.in|LinkedIn profile